Market Dynamics

Introduction

Artificial Intelligence (AI) is increasingly being used in military applications, from autonomous weapons systems to logistics and planning tools. AI can help to improve the speed, accuracy, and efficiency of military operations, while also reducing the risk of human casualties. Autonomous weapons systems, such as drones and unmanned vehicles, can be used for reconnaissance, surveillance, and targeted strikes, while AI-powered logistics tools can help to optimize supply chains and manage troop movements.

However, the use of AI in military applications also raises ethical and legal concerns, particularly around the use of lethal autonomous weapons systems and the potential for unintended consequences.

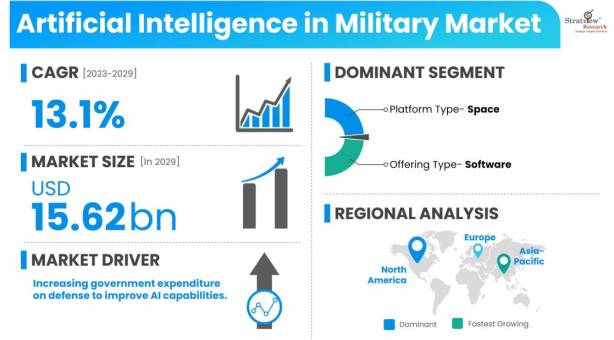

The expansion of the artificial intelligence market within the military industry can be explained by the growing investment in the creation of AI-integrated systems, along with the increasing adoption of cloud-based applications and high-performance computers. Nevertheless, the market's growth is being hindered by protectionist policies and the absence of standardized protocols, resulting in restricted access to military platforms.

Market Drivers

Increasing government expenditure on defense to improve AI capabilities

As per the Stockholm International Peace Research Institute (SIPRI), the worldwide military expenditure in 2022 was evaluated at USD 2,113 billion, indicating a growth of 3.6% compared to the previous year's spending. This escalation can be attributed to the upsurge in conflicts between nations, resulting in the reinforcement of their defense capabilities.

For example, in 2022, more than ten significant international conflicts took place, such as the Russia-Ukraine War, Syrian Civil War, the Saudi Arabia-Yemen conflict, US-Iran tensions, India-China tensions, and China-Taiwan tensions.

These types of conflicts often lead to an augmented acquisition of advanced weapon systems that utilize AI technology, as well as the integration of novel technologies into pre-existing systems to enhance their effectiveness.

Numerous governments have established specialized departments or agencies that focus on devising, commencing, and incorporating AI capabilities into existing equipment, as well as developing new capabilities. The National Science and Technology Council in the US, the Strategic Council for AI Technologies in Japan, and the AI Council in the UK are a few examples of such agencies.

In January 2021, the UK AI Council presented a roadmap to the UK Government, proposing that it increase sustainable public sector investment in AI and invest in The Alan Turing Institute (UK) to promote development and secure strategic leadership for the UK in AI research.

The UK Government's Research & Development Roadmap from July 2020 also features comparable initiatives. The report notes that the Defence and Security Accelerator (DASA) is collaborating closely with the Institute for Security Science and Technology (ISST) at Imperial's White City Campus in the UK to unite the government, academia, industry, and small and medium-sized enterprises (SMEs) to explore creating the next wave of solutions for security and defense challenges.

Want to have a closer look at this market report? Click Here

Increasing Threats of Cyber Attacks

The defense industry worldwide faces a constant threat of cyberattacks. For instance, in September 2019, SolarWinds, a US technology company, experienced a hack that exposed sensitive data of numerous hospitals, universities, and US government agencies.

Another notable incident occurred in October 2020, when the FBI and the US Cyber Command revealed that a North Korean group had hacked think tanks, individual experts, and government entities of the US, Japan, and South Korea to illegally obtain intelligence, including nuclear policies.

Current cybersecurity technology falls short in terms of addressing advanced ransomware and spyware threats. The above-mentioned SolarWinds hack was discovered when FireEye, a cybersecurity provider, was investigating one of its hacks.

These incidents highlight the growing significance of advanced cybersecurity capabilities. Artificial intelligence-based cybersecurity solutions can be trained to independently collect data from various sources, analyze the data, correlate it with signals of cyberattacks, and take appropriate actions, making them a valuable deployment.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Platform Type Analysis

|

Airborne, Land, Naval, Space

|

Space segment of the Artificial Intelligence in military market to grow at the highest CAGR over the forecast period.

|

|

Offering Type Analysis

|

Hardware, Software, Services

|

Software segment of the Artificial Intelligence in Military market to witness the highest CAGR during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America market to contribute the largest share from 2023 to 2029 in the Artificial Intelligence in Military market.

|

By Platform Type

Space segment of the Artificial Intelligence in military market to grow at the highest CAGR over the forecast period."

Based on the platform, the space segment of the Artificial Intelligence in military market is to grow at the highest CAGR over the forecast period. The space segment of the AI in military market is anticipated to experience the highest CAGR during the forecast period, based on the platform. The space AI segment is made up of CubeSats and satellites. AI systems for space platforms consist of multiple satellite subsystems that serve as the foundation for various communication systems. The incorporation of AI into space platforms enables efficient communication between spacecraft and ground stations.

By Offering Type

"Software segment of the artificial intelligence in military market to witness the highest CAGR during the forecast period."

By offering the software segment of the artificial intelligence in military market to witness the highest CAGR during the forecast period. The software segment is expected to experience the highest CAGR during the forecast period based on offering. Technological advancements in the field of AI have led to the creation of advanced AI software and related software development kits.

The AI software integrated into computer systems is responsible for performing complex operations. It combines data received from hardware systems and processes it in an AI system to generate an intelligent response. The Software segment is projected to witness the highest CAGR because of the importance of AI software in fortifying the IT infrastructure to prevent security breaches.

(1)_71002.jpg)

Want to get more details about the segmentations? Register Here

Regional Insights

"North American market to contribute the largest share from 2023 to 2029 in the artificial intelligence in military market."

The North American region, particularly the US and Canada, are essential countries for market analysis. This region is expected to lead the market between 2023 and 2029 due to the increased investments in AI technologies by the countries in the region.

The US is leading this market, investing heavily in AI systems to maintain its combat superiority and reduce the risk of potential threats on computer networks. The US plans to increase its spending on AI in the military to gain a competitive edge over other countries.

The US is recognized as one of the primary manufacturers, exporters, and users of AI systems globally, with the strongest AI capabilities. Key manufacturers of AI systems in the US include Lockheed Martin, Northrop Grumman, L3Harris Technologies, Inc., and Raytheon. The new defense strategy of the US highlights an increase in AI spending to include advanced capabilities in existing defense systems of the US Army to counter incoming threats.

Know the high-growth countries in this report. Register Here