Market Insights

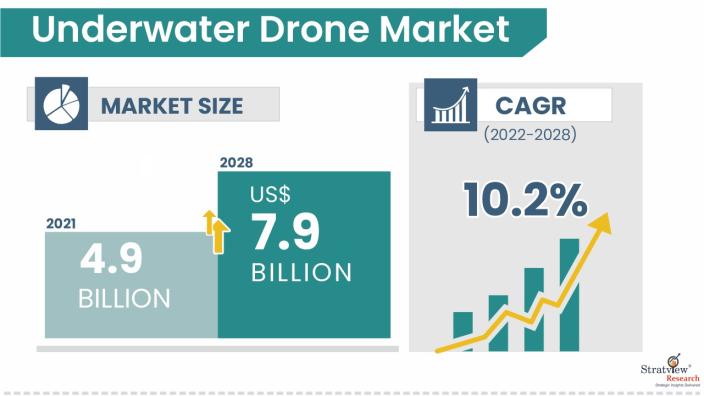

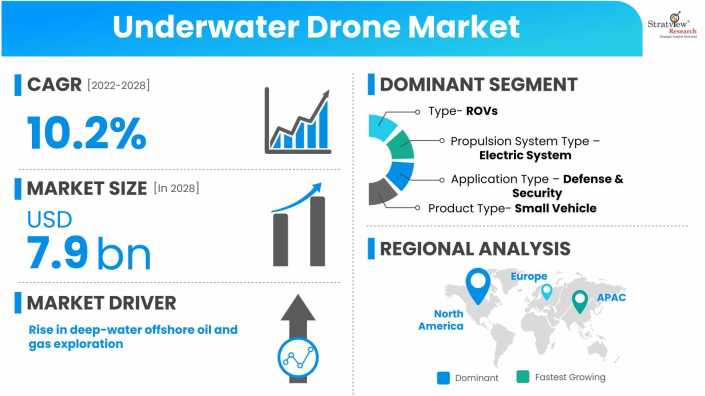

The underwater drone market was estimated at USD 4.9 billion in 2021 and is likely to grow at a CAGR of 10.2% during 2022-2028 to reach USD 7.9 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Unmanned underwater vehicles (UUVs), commonly referred to as underwater drones, are a class of vehicles that can operate in the ocean and sea without a human occupant. The two main types of these machines are remotely operated underwater vehicles (ROVs), which are directed by a distant human operator throughout their operations, and autonomous underwater vehicles (AUVs), which are able to operate on their own without any real-time human inputs. A reduction in the amount of time needed to inspect equipment and other submerged items has been made possible by technological advancements in unmanned underwater vehicles, such as high-resolution cameras, superior manipulator arms, and highly sensitive sonar. This has created an ocean of opportunity in the underwater drone market.

COVID-19 Impact

The COVID-19 pandemic has compelled governments all around the world to prioritize healthcare. As a result, the nations are cutting back on their military spending to help pay for the pandemic response and recovery efforts. To put more money toward the pandemic response, countries like South Korea and Thailand have cut back on their military spending.

Market Drivers

The main element influencing the uptake of underwater drones is the rising demand for these drones among customers engaged in water-related activities like swimming and diving. Due to the addition of these underwater drones to Navy security gear, the use of underwater drones for defense has expanded. Energy-efficient drones are already available on the market as a consequence of ongoing research and development to improve the operability of underwater drones. These underwater vehicles mostly rely on renewable energy sources or clever movement strategies, and they seldom utilize their on-board batteries. Products that employ renewable energy sources like wind, solar, and others have been introduced to the market.

During the anticipated period, it is anticipated that factors such as

- The rise in deep-water offshore oil and gas exploration

- The rise in demand for underwater drones for defense and security applications

- The rise in demand for oceanographic research

- The rise in government support for the modernization of military forces

The projection period is likely to see a slowdown in the growth of the underwater drone market due to communication issues with AUVs.

- The U.S. Energy Information Administration (EIA) forecast that between 2018 and 2050, the world's energy consumption will increase by almost 50%. This prediction was made in the recently published International Energy Outlook 2019 (IEO2019). Oil and gas businesses, which make up a significant portion of the energy market, are increasing the output, effectiveness, and safety of their assets as a result of the rising global demand for energy. The majority of the world's oil and gas reserves are submerged in the sea. Oil and gas corporations are now able to dig thousands of feet below the surface and more than 100 miles offshore because of improvements in oil and gas exploration, drilling, and production. Deep-water oil and gas production is moving away from traditional floating platforms and toward wellheads on the seafloor that are linked to pipes on the seafloor.

- These systems rely on improved remote surveillance tools and autonomous installations, which include unmanned underwater drones. The use of ROVs and AUVs is anticipated to increase dramatically as operators continue to seek oil and gas sources in deeper seas. Drones that operate underwater improve operational security, aid in drilling and subsea building, lessen the influence of inspection activities on the environment and need fewer staff deployments. Drones that operate underwater provide an alternative to deploying divers to do routine inspection work. Drone inspection work is secure, effective, and less harmful to the environment than routine monitoring and inspection.

- In September 2020, Kraken Robotics Inc. revealed that its subsidiary, Kraken Robotic Systems Inc., has started the first stage of its OceanVision project in accordance with the goals of performing oil and gas exploration and inspection. Kraken will utilise its underwater equipment to map and image the seabed on Newfoundland's Grand Banks and other locations in Atlantic Canada. The oil and gas industry's growing need for underwater drones has led to the ROV and AUV manufacturers providing systems with longer underwater uptimes.

Want to have a closer look at this market report? Click Here

Several investments/guidelines in the industry have been directed in recent years, which would boost the overall market. Some of them are:

- Unsustainable marine resource exploitation has had a negative influence on the oceans, causing pollution and a collapse in fish supplies all over the world. The marine ecology has been damaged by land-based pollution, habitat loss, climate change, and unsustainable resource exploitation. Over the years, scientists and professionals have created a bottom-up campaign to address the declining health of the oceans, which finally persuaded the United Nations General Assembly to announce a Decade of Ocean Science for Sustainable Development in 2017. (2021–2030). Under this, governments and scientists are bringing attention to the oceans' alarming reduction in resources and health. To improve ocean management, relief strategies supported by science and technology are needed.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Type Analysis

|

Remotely Operated Vehicle (ROV), Autonomous Underwater Vehicles (AUV), and Hybrid Vehicles

|

The remotely operated vehicle segment holds the highest market share in 2021.

|

|

Propulsion System Type Analysis

|

Electric System, Mechanical System, and Hybrid System

|

The electric systems segment will show significant growth in the market during 2022-2028.

|

|

Application Type Analysis

|

Defense & Security, Scientific Research, Commercial Exploration, and Others

|

The defense & security segment holds the highest market share in 2021 and is expected to lead the market during the forecast period.

|

|

Product Type Analysis

|

Micro, Small and Medium, Light Work-Class, and Heavy Work-Class

|

The small vehicle segment will have considerable growth throughout the projection period.

|

|

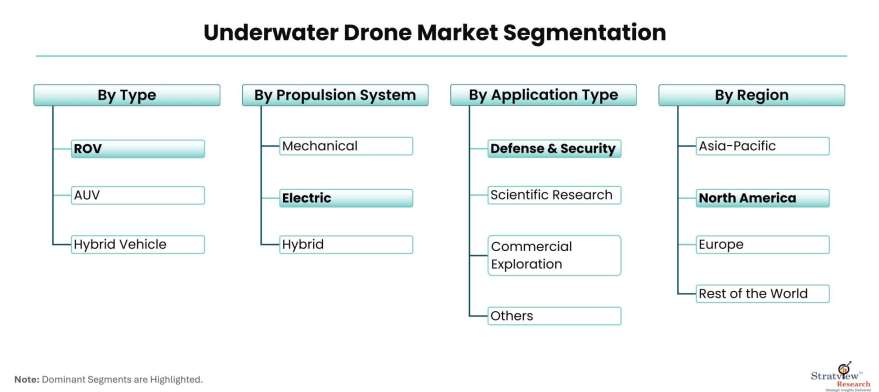

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America has the largest market share in the world, and the United States is the world's largest producer, operator, and exporter of such vehicles.

|

By Type

The market is divided into three categories based on type: Remotely operated underwater vehicles (ROV), autonomous underwater vehicles (AUV), and hybrid vehicles. The remotely operated vehicle segment holds the highest market share in 2021. The ROVs are mostly used for critical missions and work the best in challenging environments. During the forecast period, the autonomous underwater vehicle segment will experience significant growth.

By Propulsion System Type

The market is divided into three categories according to propulsion system: electric, mechanical, and hybrid. The electric systems segment will show significant growth in the market during 2022-2028.

By Application Type

The market is divided into four categories based on application: commercial exploration, scientific research, defense & security, and others. The defense & security segment holds the highest market share in 2021 and is expected to lead the market during the forecast period. The defense forces' increased use of underwater drones to fight maritime security threats, such as submarine warfare, seabed mines, anti-ship & anti-submarine missiles, and others, is the cause of this expansion.

By Product Type

The underwater drone market is divided into four product categories: micro, small and medium, light work-class, and heavy work-class. Due to growing use in applications for observations of water column properties, monitoring, and benthic zones, the small vehicle segment will have considerable growth throughout the projection period. For deep-water surveys, high-capacity electric vehicles are used. A wide variety of sensors, communication systems, and navigation and positioning systems are included in the heavy work class vehicles.

Regional Insights

The market is examined in terms of its impact on North America, Europe, Asia-Pacific, and LAMEA. North America has the largest market share in the world, and the United States is the world's largest producer, operator, and exporter of such vehicles. The increasing use of remotely operated vehicles (ROVs) in commercial and defence sectors is expected to drive growth in the North American ROVs market. Asia Pacific underwater drone market is expected to grow significantly. The increase can be attributed to increased defense investments from countries such as India, China, Japan, South Korea, and others. As a result, drones can operate for longer underwater and need fewer Li-ion battery recharges.

Know the high-growth countries in this report. Register Here

Key Players

There is stiff competition in the underwater drone market. The growth of the companies is directly dependent on the industry conditions and government support. These companies differentiate their underwater drone based on their quality and penetration in the target and emerging markets. Also, some major mergers and acquisitions in the industry recently have significantly influenced the competitive dynamics. For example:

- Robotosea, an underwater drone business, has released the BIKI underwater drone, a robot fish with a 4K camera. The BIKI's built-in 4K lens includes a stabilizer and 32 GB of internal memory to capture whatever it lays its robot eyes on. Its main purpose is to allow users to view some fascinating things that they wouldn't ordinarily be able to see.

The overall competitive landscape has been affected due to these mergers and acquisitions. The following are the major players in the underwater drone market:

- Saab Seaeye Ltd

- Teledyne Marine Group

- The Boeing Company

- Lockheed Martin Corporation

- Bluefin Robotics

- Kongsberg Maritime

- ECA Group

- Oceaneering International, Inc.

- TechnipFMC plc

- Deep Ocean Engineering, Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s underwater drone market realities and future market possibilities for the forecast period of 2022 to 2028. After a continuous interest in our underwater drone market report from the industry stakeholders, we have tried to further accentuate our research scope to the underwater drone market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The underwater drone market is segmented into the following categories:

By Type

- Remotely Operated Vehicle (ROV)

- Autonomous Underwater Vehicles (AUV)

- Hybrid Vehicles

By Application Type

- Defense & Security

- Scientific Research

- Commercial Exploration

- Others

By Propulsion System Type

- Electric System

- Mechanical System

- Hybrid System

By Product Type

- Micro

- Small

- Medium

- Light Work-Class

- Heavy Work-Class

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Click Here, to learn the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].