Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Battery Market

-

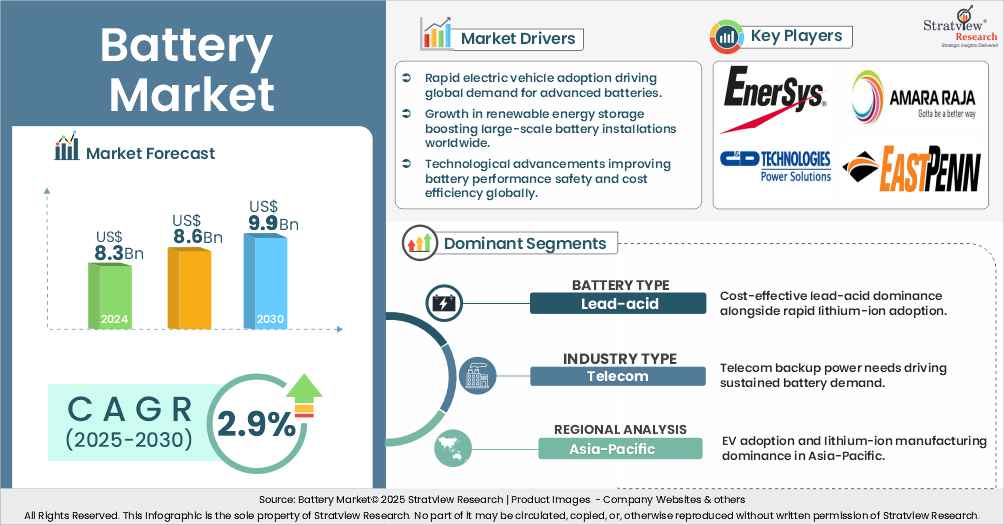

The annual demand for battery was USD 8.3 billion in 2024 and is expected to reach USD 8.6 billion in 2025, up 3.9% than the value in 2024.

-

During the forecast period (2025-2030), the battery market is expected to grow at a CAGR of 2.9%. The annual demand will reach USD 9.9 billion in 2030.

-

During 2025-2030, the battery industry is expected to generate a cumulative sales opportunity of USD 55.8 billion, which is almost 1.5 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

Asia-Pacific remains the biggest market for batteries in the years to come.

-

By battery type, Lead-acid will likely remain dominant in the market, whereas lithium-ion is anticipated to maintain its growth momentum.

-

By industry type, Telecom remains the biggest demand generator for batteries. Aviation, in the post-pandemic market developments, is likely to rebound at the fastest pace.

Market Statistics

Have a look at the sales opportunities presented by the battery market in terms of growth and market forecast.

|

Battery Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 8.0 billion

|

-

|

|

Annual Market Size in 2024

|

USD 8.3 billion

|

YoY Growth in 2024: 4.1%

|

|

Annual Market Size in 2025

|

USD 8.6 billion

|

YoY Growth in 2025: 3.9%

|

|

Annual Market Size in 2030

|

USD 9.9 billion

|

CAGR 2025-2030: 2.9%

|

|

Cumulative Sales Opportunity during 2025-2030

|

USD 55.8 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 6.6 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 4.2 billion to USD 5.8 billion

|

50% - 70%

|

Market Dynamics

What is a Battery?

A battery is an electrochemical energy storage device that stores electrical energy in chemical form and releases it as electricity when required. It consists of one or more electrochemical cells, each comprising a positive electrode (cathode), a negative electrode (anode), an electrolyte, and a separator. When connected to a circuit, controlled chemical reactions generate a flow of electrons, producing usable electrical power.

Batteries are widely used across electric vehicles (EVs), renewable energy storage systems, consumer electronics, industrial equipment, and backup power applications.

Market Drivers:

Rising Electric Vehicle Adoption Driving Battery Demand

-

The continued expansion of electric mobility, especially electric cars, remains the primary driver of global battery demand. According to the International Energy Agency (IEA), EV battery demand is projected to exceed 3 TWh by 2030 under current policy scenarios, supported by sustained growth in electric passenger vehicles, buses, and commercial fleets worldwide.

-

This long-term demand visibility is encouraging large-scale investments in battery manufacturing capacity, supply chains, and technology development, strengthening the overall growth outlook of the battery market.

Rapid Expansion of Battery Energy Storage Systems (BESS)

-

Battery energy storage systems (BESS) are emerging as a significant growth driver within the broader battery market, driven by increasing deployment to support renewable energy integration and grid flexibility. In 2025, global BESS installations rose sharply, representing around 50% year-on-year increase compared with 2024.

-

This rapid scale-up reflects growing demand for storage to balance variable solar and wind generation, provide peak capacity, and enhance grid stability. Continued policy support for clean energy transitions and grid modernization is expected to sustain strong energy storage systems deployment through 2026, reinforcing the role of storage in long-term market growth.

Declining Battery Costs Supporting Wider Adoption

-

Declining battery costs are directly accelerating demand across electric mobility and energy storage applications, making batteries commercially viable for mass-market deployment. According to the IEA, average battery pack prices for electric vehicles have declined to below USD 100 per kWh, a critical threshold that enables cost parity between electric and internal combustion engine vehicles.

-

At the same time, global battery manufacturing capacity reached nearly 3 TWh in 2024, supported by large-scale investments in gigafactories and supply chains. This expansion in production capacity, combined with falling battery costs, is reducing entry barriers for automakers, utilities, and energy developers.

- As a result, battery systems are becoming more accessible for large-scale deployment across electric mobility and grid infrastructure. Improving affordability and manufacturing scale are therefore translating into higher installation volumes, directly strengthening market demand and long-term growth potential.

Market Challenges:

Concentration of Critical Raw Material Supply

-

Battery production depends on lithium, cobalt, nickel, and graphite, whose supplies are concentrated in a few countries. The Democratic Republic of Congo supplies around 70% of global cobalt. Australia, Chile, and Argentina dominate lithium mining, Indonesia leads nickel production, and China accounts for more than 75% of global natural graphite output, a figure supported by our industry analysis, including S&P Global’s data.

-

This geographic concentration exposes manufacturers to geopolitical risks, export restrictions, and disruptions, increasing price volatility and complicating long-term capacity planning, which could constrain battery market growth.

Battery Recycling and End-of-Life Management Challenges

-

As battery deployments grow, managing end-of-life lithium-ion batteries presents a structural market challenge. Currently, only a small fraction of used batteries are formally recycled, and many economies lack organized collection and processing systems.

-

In markets like India, just 1 % of end-of-life Li-ion batteries are recycled despite demand potentially hitting 115 GWh by 2030, creating gaps in material recovery and circularity. Effective recycling infrastructure is underdeveloped, and logistical hurdles in safe collection, transport, and processing increase costs and environmental risks, constraining the development of a sustainable circular supply chain.

Market Opportunities:

Innovation in Next-Generation Battery Technologies

-

Ongoing research into technologies such as sodium-ion, solid-state, lithium-sulphur, redox-flow, and metal-air batteries offers opportunities for market differentiation and future growth.

-

Commercial adoption of these technologies can unlock new application segments (e.g., enhanced safety, higher energy density, longer durations) and reduce dependence on current lithium-ion supply chains. Even though they are nascent, they can capture niche markets and evolve toward broader use over time.

Incremental Improvements in Established Technologies

-

The IEA highlights that even incremental advances in established lithium-ion chemistries, boosting performance, energy density, safety, and cost efficiency, remain valuable. These improvements support broader adoption across EVs, grid storage, and consumer segments and can help incumbents maintain a competitive advantage while the overall market expands.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Battery Type Analysis

|

Lead-acid [Flooded, VRLA-Gel, and VRLA-AGM], Lithium-ion, and Nickel-cadmium

|

Lead-acid will likely remain dominant in the market, whereas lithium-ion is anticipated to maintain its growth momentum.

|

|

Industry Type Analysis

|

Marine, Railway, Defense, Aviation, and Telecom

|

Telecom remains the biggest demand generator for batteries. Aviation, in the post-pandemic market developments, is likely to rebound at the fastest pace.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and the Rest of the World

|

Asia-Pacific remains the biggest market for batteries in the years to come.

|

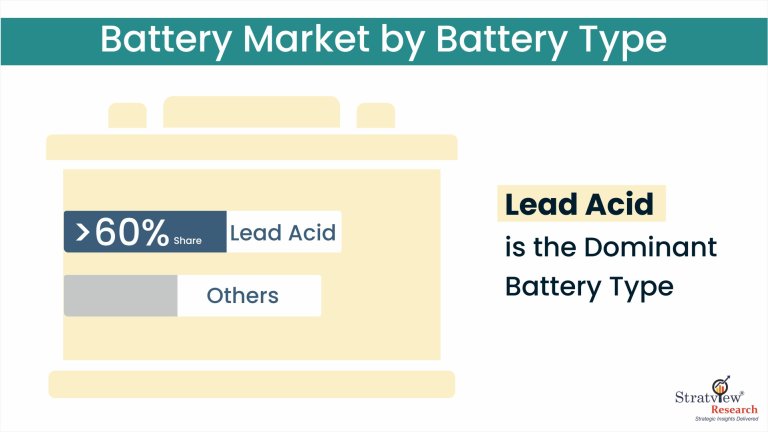

By Battery Type

“Lead-Acid Battery Segment Holds the Largest Market Share”

-

The global battery market is segmented into lead-acid, lithium-ion, and nickel-cadmium batteries. Among these, lead-acid batteries continue to dominate the market, accounting for more than 60% share, supported by their cost-effectiveness, established recycling infrastructure, and widespread use in automotive and telecom backup applications.

-

Meanwhile, lithium-ion batteries are projected to sustain strong growth momentum over the forecast period. Despite experiencing a temporary demand slowdown during the pandemic, lithium-ion technology remains the fastest-growing segment, driven by its high energy density, low self-discharge rate, and minimal maintenance requirements. Rising data traffic and expansion of wireless communication networks are further strengthening demand for advanced battery solutions.

Want to get a free sample? Register Here

By End-Use Industry

“Telecom Sector Remains the Largest Demand Contributor”

-

Based on end-use, the battery market is segmented into marine, railway, defense, aviation, and telecom. The telecom sector continues to account for the largest share of battery consumption, primarily due to the extensive use of batteries in backup power systems for towers, data centers, and network infrastructure.

-

With increasing dependence on cloud computing, data streaming, and digital services, demand for reliable and high-performance power backup solutions has intensified, reinforcing battery adoption in the telecom sector.

-

The aviation segment is expected to register the fastest growth during the forecast period, supported by recovering aircraft deliveries and growing investments in electric and hybrid aircraft technologies.

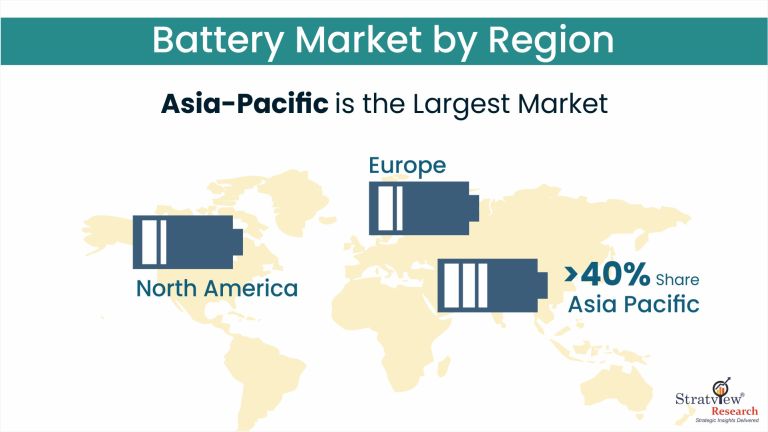

Regional Analysis

“Asia-Pacific Maintains Market Leadership”

-

The global battery market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. Among these regions, Asia-Pacific is projected to remain the largest and fastest-growing market, accounting for over 40% of global demand during the forecast period.

-

This growth is driven by rapid industrialization, expanding energy storage deployments, strong telecom infrastructure development, and rising adoption of electric vehicles and renewable energy systems. In addition, China’s leadership in lithium-ion battery manufacturing continues to strengthen the region’s competitive position.

-

North America is expected to offer significant growth opportunities, supported by a strong aviation sector and the presence of leading battery manufacturers such as EnerSys, East Penn Manufacturing, and C&D Technologies.

Want to get a free sample? Register Here

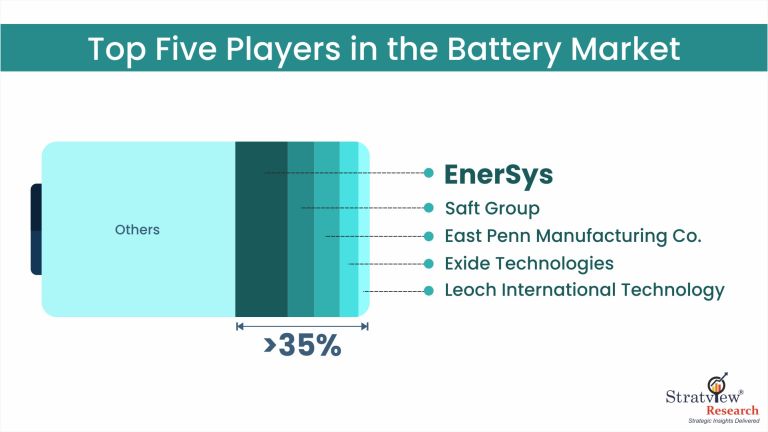

Competitive Landscape

The market is highly populated with the presence of several local, regional, and global players. Most of the major players compete in some of the governing factors including price, product offerings, regional presence, etc. Most of the major players are providing both lead-acid and lithium-ion batteries in their portfolio.

The following are the key players in the battery market (arranged alphabetically).

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Want to get a free sample? Register Here

Recent Market JVs and Acquisitions:

August 2025 – Amara Raja Increases Investment in Li-ion Cell Manufacturing

-

Amara Raja Energy & Mobility Ltd. announced an additional Rs.1,200 crore investment into its 1 GWh lithium-ion cell manufacturing project, bringing the total planned expenditure for the first phase to Rs.2,400 crore. The project, aimed at manufacturing NMC chemistry cells primarily for two-wheelers, is expected to commence production by the end of FY27. This capital infusion supports the expansion of research facilities, customer qualification plants, and the gigafactory infrastructure

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2030

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2030

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

3 (Battery Type, Industry Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The global battery market is segmented into the following categories:

Battery Market, by Battery Type

Battery Market, by Industry Type

-

Marine

-

Railway

-

Defense

-

Aviation

-

Telecom

Battery Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, Russia, and Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s battery market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]