Market Dynamics

Introduction

Maritime security refers to measures and practices implemented to safeguard the seas, oceans, and related infrastructure from threats that could compromise safety, order, or environmental integrity. It encompasses protection against piracy, terrorism, smuggling, illegal fishing, and other illicit activities at sea. Key elements include the safeguarding of maritime borders, ensuring the safety of vessels and their crews, and preventing unauthorized access to critical maritime assets.

Cooperation between nations, enforcement of international maritime laws, and the use of advanced technologies are integral to maintaining maritime security and facilitating the safe and efficient movement of goods and people across global waterways.

COVID-19 Impact

Global trade and the economy have both been severely impacted by the COVID-19 outbreak. Certain areas of the maritime industry have been touched, albeit to incredibly different degrees. This is due in part to the presence of specific activity types and the adaptability of individual firms and their disaster management plans.

The COVID-19 pandemic is a dynamic phenomenon with significant effects on the transportation sector. Security-aware vessels will still be able to trade, but secure trading will require dependable, real-time, data-driven technology.

Therefore, a drop in piracy accidents is difficult to happen, and a partial rise is very likely given the increased likelihood that protective responses will be compromised due to widespread infection. In this time of uncertainty, ships, shipowners, and the marine industry must rely on straightforward, data-driven, and practical solutions. This will encourage economic activity in this new environment.

Market Drivers

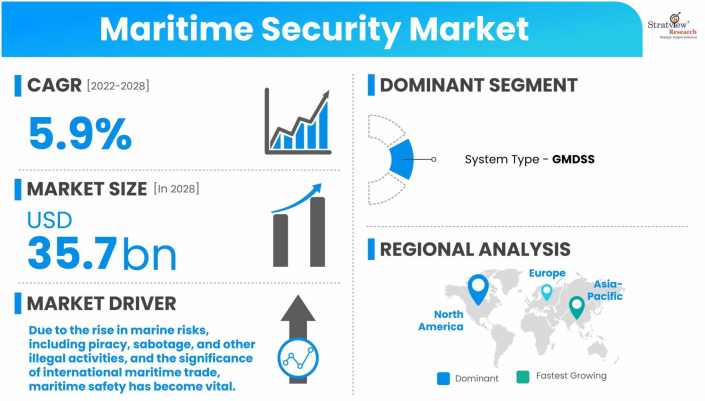

To defend against numerous marine hazards, maritime safety helps to secure ports and offers coastal surveillance technology and services. Due to the rise in marine risks, including piracy, sabotage, and other illegal activities, and the significance of international maritime trade, maritime safety has become vital.

Historically, semaphore methods and operations like coast guard and sea marshal patrol were the only components of maritime safety. But during the past few decades, there has been a profusion of modern technology, including radio and satellite communication systems, cutting-edge detection methods, and real-time onshore and underwater monitoring.

There has been a rise in interest in marine security and geopolitical relations over the past several decades. Protecting ships, ports, and other shipping infrastructure against malicious destruction by terrorism, sabotage, or subversion is the focus of maritime security. Studies show that most global trade is carried out via the maritime network.

As a result, several maritime nations in Asia are boosting their expenditures on substantial port expansion and building projects. This will increase demand for screening, scanning, and surveillance technology over the next years. Additionally, as the worldwide need for marine security grows, criminal activities, including drug trafficking, illegal immigration, and attacks on ports and coastal regions, are rising.

To function, the maritime industry must be able to handle complicated procedures and changing market situations. The industry is embracing the spike in digital technology use for shipping logistics as a chance to improve efficiency, build more innovative ships and fleets, and get ready to take advantage of global expansion. As consumer demand rises, global supply networks are expanding and more complicated.

Increasing environmental effects directly result from increased demand for goods, commodities, and raw resources. Marine businesses must immediately implement new strategies to maximize efficiency and simplify their supply chains in today's fiercely competitive market.

Users may easily arrange inventory data, track and manage shipping and tracking information, and issue electronic invoices thanks to marine and marine management software combined with cutting-edge technology. Delivering firms might save their business time and money by reducing the time spent shipping, receiving, tracking, and generating order data. Additionally, the maritime industry is beginning to recognize the importance of digitization and recent advancements in AI, blockchain, IoT, and automation.

They support the transformation of supply chains, the creation of new business prospects, and the streamlining of existing operations. With the help of design and simulation tools, warehouse management, transportation and yard management, and end-to-end control of the logistics network, the marine and marine management software provides end users with a way to manage supply chain activities efficiently.

The Gulf of Aden and the Indian Ocean have fewer piracy assaults than other West African maritime routes. These routes take longer and use more gasoline, though. Customers are responsible for paying the additional gasoline costs. In locations with significant pirate dangers, marine safety must be addressed to decrease this.

A worldwide database on maritime piracy is now being created. A few tools and technology can examine pirate networks. This will make it easier for the nations to find and apprehend pirates on the high seas. The volume of data gathered from sources across networks, users, endpoints, and apps is expanding as organizations expand.

Want to have a closer look at this market report? Click Here

Several investments/guidelines in the industry have been directed in recent years, which would boost the overall market. Some of them are:

- Major ports, waterways, and maritime agencies are not the only ones to deploy advanced Vessel Traffic Services (VTS) technology. They are also heavily utilised for incident management and maritime rescue coordination. In the marine industry, incident detection is crucial. The use of surveillance equipment like radar, sonar, the Automatic Identification System (AIS), closed-circuit television (CCTV), and others is required to provide operators with real-time situational awareness. Therefore, there is a high demand for an integrated solution that would give a platform and enable data analysis to stop maritime terrorism and piracy.

Recent Developments

There is stiff competition in the maritime security market. The growth of the companies is directly dependent on industry conditions and government support. These companies differentiate their maritime security based on their quality and penetration in the target and emerging markets. Also, some major mergers and acquisitions in the industry recently have significantly influenced the competitive dynamics. For example:

- In January 2022, Honeywell unveiled a novel, new low-global-warming-potential (GWP) refrigerant for commercial and industrial refrigeration that is tailored for supermarkets. Before any legislative changes, the product satisfies the demands of supermarkets and merchants looking for low-global-warming alternatives.

Segments Analysis

By Security Type

The market is segmented into coastal surveillance, vessel security, crew security, cargo and container safety, and ship system and equipment (SSE) safety.

By System Type

The system segment is segmented into ship security reporting system, automatic identification system, global maritime distress safety system, longer-range tracking and identification system, vessel monitoring and management system, and others. In the upcoming years, there will likely be an increased need for marine safety systems with tiny target detection capabilities to help authorities effectively monitor criminal operations, including illegal immigration, smuggling, illicit fishing, drug trafficking, piracy, and terrorism.

Regional Insights

“North America is expected to dominate the market, while the Asia Pacific region is projected to experience the highest CAGR during the forecast period”.

The market is broken down geographically into areas like North America, Europe, Asia-Pacific, and the Rest of the World (RoW). In terms of regions, North America is likely to maintain its supremacy in the maritime security market throughout the forecast period. Rapid modernization and technological advancements in various sectors have resulted in a high rate of maritime security.

Concurrently, the maritime security market in the Asia Pacific is anticipated to expand at the highest CAGR during the forecast period. The main economies in this region are emphasizing modernizing their existing military systems, which is driving the growth of the Asia Pacific maritime security market.

Know the high-growth countries in this report. Register Here