Market Insights

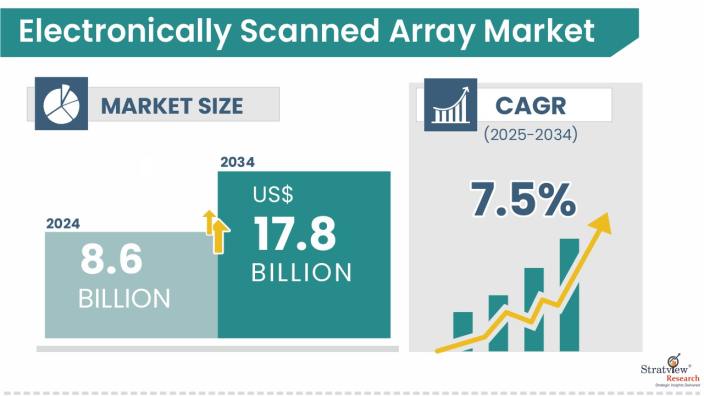

The electronically scanned array market size was USD 8.6 billion in 2024 and is likely to grow at a strong CAGR of 7.5% during 2025-2034 to reach USD 17.8 billion in 2034.

Want to know more about the market scope? Register Here

Market Dynamics

The electronically scanned array (ESA) market refers to the global industry involved in the design, development, production, and sale of antenna systems that can electronically steer the direction of their beams without physically moving the antenna itself. These arrays are crucial components in radar systems, satellite communications, electronic warfare, and modern defense systems.

In simple terms, an electronically scanned array is a type of antenna system made up of multiple small antennas (called elements), where the direction of the radio wave beam is changed by varying the phase of the signal at each element. This process allows for rapid and precise beam steering, making ESAs highly effective in applications that require real-time tracking, surveillance, and target acquisition.

Market Drivers

The ESA market is growing rapidly due to increasing demand from the military and aerospace industries, advancements in telecommunication infrastructure, and rising investment in space and satellite technology.

Recent Market JVs and Acquisitions:

Recently, the electronically scanned array (ESA) market has witnessed a surge in joint ventures and acquisitions as companies aim to strengthen their technological capabilities, expand their global footprint, and enhance their product portfolios. These strategic collaborations are driven by the growing demand for advanced radar and communication systems across defense, aerospace, and commercial industries. Firms are increasingly partnering to leverage each other's expertise in materials, signal processing, and system integration, enabling faster innovation and improved performance in ESA technologies. Additionally, acquisitions are being used as a means to gain access to specialized technologies and skilled talent, ultimately fostering competitiveness and accelerating time-to-market for next-generation ESA systems

A considerable number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

- In November 2024, Teledyne Technologies completed the acquisition of Excelitas Technologies' Optical Systems and Advanced Electronic Systems businesses for $710 million, bolstering its portfolio in advanced optics and defense electronics.

- In February 2024, Thales announced a partnership with Airbus to develop and integrate AESA radars for future European fighter jets, aiming to strengthen European defense capabilities.

- In April 2023, Milexia, a European high-tech electronics distributor, acquired France-based Composants Electroniques Lyonnais (CEL).

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Product-Type Analysis

|

AESA and PESA

|

AESA is expected to dominate the market throughout the forecast period due to the widespread adoption of AESA systems in modern military aircraft, naval vessels, and ground-based defense platforms.

|

|

Platform-Type Analysis

|

Airborne, Naval, and Land

|

Airborne is expected to exhibit the highest growth rate during the forecast period, driven by continuous investments in next-generation fighter programs and the integration of advanced radar systems in UAVs and other aerial platforms.

|

|

Component-Type Analysis

|

Transceiver Module, Phase Shifters, Beamforming Network, Signal Processing Module, Radar Data Processor, and Others

|

Transceiver module is anticipated to dominate during the forecast period due to their significance in modern radar and communication systems.

|

|

Application-Type Analysis

|

Fire Control Radar, Tactical Data Link Radar, Air Traffic Control Radar, and Others

|

Fire Control Radar is expected to grow at the highest CAGR during the forecast period, driven by the increasing demand for advanced targeting systems in military operations and the continuous modernization of defense equipment.

|

|

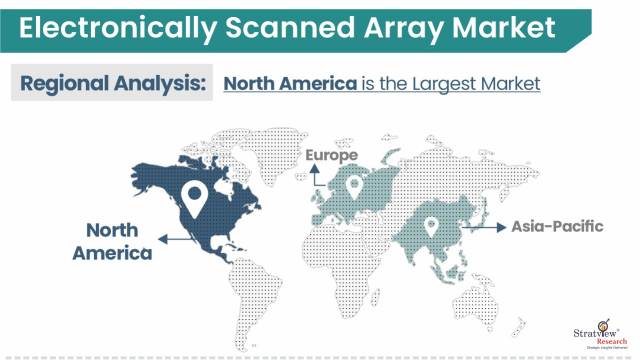

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is expected to continue its dominance throughout the forecast period.

|

By Product Type

“The AESA segment is expected to dominate the market during the forecast period.”

Based on the product, the market is segmented into AESA and PESA. The AESA segment currently dominates the ESA market and is expected to maintain its leading position throughout the forecast period. This dominance is attributed to the widespread adoption of AESA systems in modern military aircraft, naval vessels, and ground-based defense platforms, owing to their superior performance and versatility. In addition to its dominant market share, the AESA segment is also expected to experience the highest CAGR among the two segments, driven by increasing demand for advanced radar systems in defense and aerospace applications, as well as ongoing technological advancements that enhance the capabilities of AESA systems.

By Platform Type

“The airborne segment is expected to exhibit the highest growth rate throughout the forecast period.”

Based on the platform, the market is segmented into airborne, naval, and land. The airborne segment is expected to continue its dominance in the ESA market. This dominance is attributed to the widespread adoption of ESA systems in various aerial platforms, including fixed-wing aircraft, rotary-wing aircraft, and unmanned aerial vehicles (UAVs). It is also expected to register the highest CAGR in the ESA market, driven by continuous investments in next-generation fighter programs and the integration of advanced radar systems in UAVs and other aerial platforms.

By Component Type

“The transceiver module segment is expected to continue its dominance throughout the forecast period.”

Based on the component, the market is segmented into transceiver module, phase shifters, beamforming network, signal processing module, radar data processor, and others. The transceiver module segment is expected to dominate the ESA market in terms of market share during the forecast period. Transceiver modules are crucial components that handle both the transmission and reception of radio frequency signals, enabling precise beam steering and rapid target tracking. Their significance in modern radar and communication systems, especially within defense and aerospace applications, underscores their leading position in the market. The increasing demand for advanced radar and communication systems suggests that components like signal processing modules and beamforming networks are expected to experience substantial growth. These components are integral to enhancing the performance and capabilities of ESA systems, and their development is driven by the need for more sophisticated signal analysis and beam control in various applications.

By Application Type

“The fire control radar segment is expected to exhibit the highest growth rate throughout the forecast period.”

Based on the application, the market is segmented into fire control radar, tactical data link radar, air traffic control radar, and others. The fire control radar segment is anticipated to dominate the ESA market during the forecast period. This dominance is attributed to its extensive application in fixed and rotary-wing military aircraft, as well as certain unmanned aerial vehicles. Furthermore, the segment is also expected to experience the highest CAGR among the application segments. This growth is driven by the increasing demand for advanced targeting systems in military operations and the continuous modernization of defense equipment.

Regional Insights

“The North America region is expected to continue its dominance in the market during the forecast period.”

North America is expected to dominate the market due to the presence of key players and significant investment in advanced radar systems, electronic warfare, and space-based communication.

Asia Pacific is expected to witness the highest CAGR because of increasing indigenous development and procurement of ESA technologies in the region and growing demand for border surveillance, air defense systems, and satellite communication.

Know the high-growth countries in this report. Register Here

Key Players

The market consists of a considerable number of players, featuring several key players renowned for their expertise and contributions. The following are the key players in the electronically scanned array market.

Here is the list of the Top Players (Based on Dominance)

- Raytheon Technologies Corporation

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Leonardo S.p.A.

- Thales Group

- BAE Systems plc

- Israel Aerospace Industries (IAI)

- Saab AB

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s electronically scanned array market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruit available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The electronically scanned array market is segmented into the following categories.

Electronically Scanned Array Market, by Product Type

- AESA (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- PESA (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

Electronically Scanned Array Market, by Platform Type

- Airborne (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Naval (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Land (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

Electronically Scanned Array Market, by Component Type

- Transceiver Module (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Phase Shifters (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Beamforming Network (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Signal Processing Module (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Radar Data Processor (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

Electronically Scanned Array Market, by Application Type

- Fire Control Radar (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Tactical Data Link Radar (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Air Traffic Control Radar (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

Electronically Scanned Array Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Argentina, and Others)

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].