Market Insights

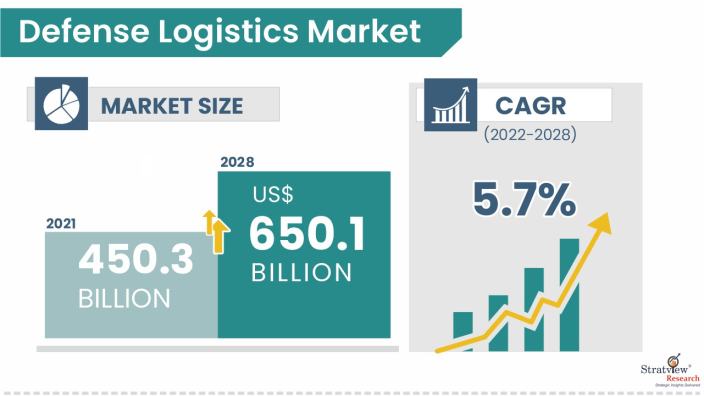

The defense logistics market was estimated at USD 450.3 billion in 2021 and is likely to grow at a CAGR of 5.7% during 2022-2028 to reach USD 650.1 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Defense logistics involves transporting supplies, machinery, inventory, and personnel between various locations. It includes distribution, administration of the materials, and supply. Defense logistics include providing military forces with supplies during the conflict. It also considers the national transportation network's capacity to convey the troops to be deployed, the nation's infrastructure and manufacturing base's capacity to equip, support, and supply the Armed Forces, and its capacity to restock that force once it has been deployed.

Market Drivers

The market for defense logistics is quite active and has a great deal of potential. In military conflicts, logistics frequently plays a key role in determining the final result of battles. Defense logistics is actively incorporated into military operations to improve situational awareness and provide real-time information for effective mission and resource allocation. Additionally, the military forces' ongoing modernization and improvements in logistics are resulting in the integration of reliable technologies in infrastructure and logistics, which in turn is fueling the expansion of the defense logistics industry.

Defense supply involves more than merely providing military weaponry during times of conflict. It also comprises the capability to prepare the armed forces for deployment, replenish that force after deployment, and equip, sustain, and supply the armed forces with national manufacturing facilities and infrastructure. On the battlefield, the military forces must display their highest level of performance while yet being mobile and sustainable. Thus, defense logistics assists in carrying out search and rescue missions, support and maintenance tasks, etc., as well as moving soldiers, ammunition, medical supplies, and food to difficult regions.

Because national security comes first, all military acquisition, maintenance, and logistics relating to the defense sector continue even while the globe battles the COVID-19 outbreak. Additionally, the nationwide lockdown and supply chain irregularities are causing the logistics provider to experience a cash issue. Businesses located in or dependent on supply chain activities from countries that the epidemic has severely hit are the first victims of the disease. Technology companies are putting a greater emphasis on high-demand inventions and developing innovative methods of supporting their customers.

The Defense Supply Agency was renamed the Defense Logistics Agency (DLA) in 1977, and the Under Secretary of Defense for Acquisition, Technology, and Logistics was given charge of, direction from, and control over the DLA, according to the Federal Register. DLA helps the military forces acquire weapons and other equipment and meet logistical needs. All military branches and federal agencies get technical and logistical support from the Agency. The demands of the military services are consolidated by agency supply centers, which purchase enough supplies to cover their anticipated requirements. Fuel, food, clothes, building materials, electrical goods, general supplies, industrial supplies, and medical supplies are just a few commodities the Agency controls.

|

Defense Logistics Market Report Overview

|

|

Market Size in 2021

|

USD 450.3 billion

|

|

Market Size in 2028

|

USD 650.1 billion

|

|

CAGR (2022-2028)

|

5.7%

|

|

Base Year of Study

|

2021

|

|

Trend Period

|

2016-2020

|

|

Forecast Period

|

2022-2028

|

Several investments/guidelines in the industry have been directed in recent years, which would boost the overall market. Some of them are:

- Technology developments that might considerably increase defense logistical capability in the Maritime, Land, and Air domains are sought after by the UK MOD (Ministry of Defense). About USD 1.1 million may be allocated to various initiatives, with projects showcasing their invention at a demonstration event held in the UK in September 2021.

- In Europe, fighter planes completed test flights using just biofuel in recent months, the first 3D-printed unmanned aerial vehicle (UAV) was sent to a battle zone, and gloves with power-generating capabilities that can keep soldiers warm in frigid regions were put to the test. The tactical and logistical aspects of combat are evolving due to new technology.

Segments Analysis

By Service Type

The market may be divided into armament, military troops, technical support & maintenance, medical aid, fire-fighting protection, and others.

By Transportation Mode Type

The market may be divided into segments: roadways, airways, seaways, and railways.

By End-User Type

The market may be divided into army, navy, air force, and others.

Regional Insights

Regarding regions, the defense logistics market may be split into numerous regional divisions, including Latin America, the Middle East, Europe, North America, and Asia-Pacific. The North American area has been acting as a pioneer in the market. The region is anticipated to substantially influence the global market throughout the forecast period due to prominent industry players. The Asia Pacific market sector is expected to see the highest growth in the next years due to India and China's increased investment in military activities to bolster their present military capabilities. Accordingly, based on the complete market viewpoint, every geographic location will contribute to the market performance throughout the projected period.

Know the high-growth countries in this report. Register Here

Key Players

The market for defense logistics is fiercely competitive and characterized by several notable competitors vying for market dominance. Introducing new competitors is anticipated to be hampered by the defense industry's tight safety and regulatory standards. Additionally, dominating markets like the US significantly impact the market, as do the general economic conditions. As a result, contracts may be postponed or canceled during a recession, resulting in a slower growth rate and negatively impacting the market dynamics.

There is stiff competition in the defense logistics market. The growth of the companies is directly dependent on industry conditions and government support. These companies differentiate their defense logistics based on their quality and penetration in the target and emerging markets. Also, some major mergers and acquisitions in the industry recently have significantly influenced the competitive dynamics. For example:

- The Italian Air Force and A-ICE collaborated to develop the Collaborative Logistics Optimization System (CLOS), a smart decision-making software tool for expediting and optimizing defense logistics mission planning, in 2019. It already offers ways to automate and simplify some processes. It employs a powerful machine-learning algorithm to accomplish the benefits of task management optimization in real time depending on various programmable factors, including capacity, cargo, and location. Some military decision-makers think it will be advantageous to adapt and incorporate important, already-existing, and tested solutions for military usage based on e-commerce technologies. Operational agility in close to real-time is required for defense logistics and storage of the future.

The overall competitive landscape has been affected due to these mergers and acquisitions. The following are the major players in the defense logistics market:

- AECOM

- Anham FZCO

- ASELSAN A.S.

- BAE Systems Plc

- KBR, Inc.

- Lockheed Martin Corporation

- DynCorp International LLC

- Fluor Corporation

- Honeywell International, Inc.

- Thales Group

- Crowley Maritime Corp.

- General Dynamics Corp.

- Northrop Grumman Corp.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s defense logistics market realities and future market possibilities for the forecast period of 2022 to 2028. After a continuous interest in our defense logistics market report from the industry stakeholders, we have tried to further accentuate our research scope to the defense logistics market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The defense logistics market is segmented into the following categories:

By Services Type

- Armament

- Military Troop

- Technical Support & Maintenance

- Medical aid

- Fire-fighting Protection

- Others

By Transportation Mode Type

- Roadways

- Airways

- Seaways

- Railways

By End-User Type

- Army

- Navy

- Air Force

- Others

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].