Market Insights

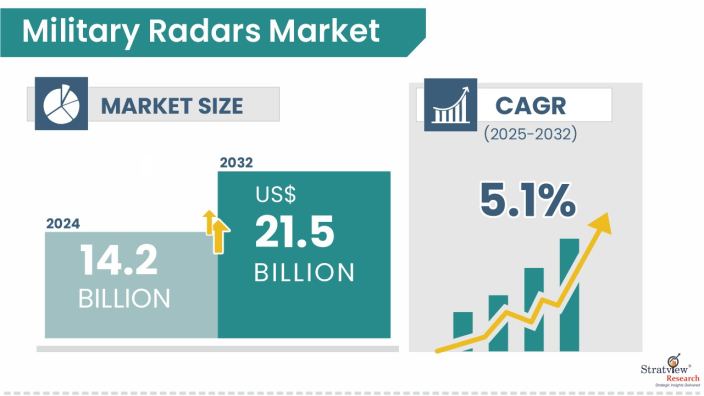

The military radars market was estimated at USD 14.2 billion in 2024 and is likely to grow at a CAGR of 5.1% during 2025-2032 to reach USD 21.5 billion in 2032.

Wish to get a free sample? Click Here

Market Dynamics

Introduction

With major advancements similar to radar technology and independent drones, border surveillance has evolved with time. Man-movable ground surveillance radars for border security have enabled many countries to secure their borders more efficiently. These surveillance radars are placed strategically on borders and play an important part in detecting possible invasions.

Developing new-generation weapons with high-end technologies is a major concern for strategic locales and platforms, similar to military airbases and vessels. Some of these new developments include nuclear-capable ballistic missiles and high-speed voyage missiles.

Nuclear ballistic missiles could destroy various metropolises and lives. Many nations are developing advanced munitions to defeat high-end air defense systems similar to the Medium Extended Air Defense System and S-400. Countries like India, China, and Russia have developed hypersonic missiles that are difficult to block for bullet security.

India and Russia have concertedly developed the BrahMos bullet, which is difficult to block by aged bullet defense securities. These developments have led to demand for new-generation high-speed air defense radar systems.

Several investments/guidelines in the industry have been directed in recent years, which would boost the overall market. Some of them are:

One of the major players, Raytheon, is providing the U.S. Army with its next-generation, 360-degree capable radar. Moreover, the company will receive more than USD 384 million to deliver six production representative units of the advanced Lower Tier Air and Missile Defense Sensor (LTAMDS) radar under the Other Transactional Authority U.S. Army agreement.

Market Drivers

The military radars market is driven by a host of factors, some of which are noted below:

- Increasing security concerns are partnered with increasing defense budgets.

- Technological boost is positively impacting the industry and leading towards the development of lightweight radars.

- A high demand for military radar systems has been created by strategic mergers of industry players and an increased emphasis on border protection activities.

- Rejuvenation activities of military equipment and legacy systems across the world are creating new opportunities for market expansion.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Component Analysis

|

Antennas, Transmitters, Receivers, Power Amplifiers, Duplexers, Digital Signal Processors, Stabilization System, Graphical User Interfaces

|

The Antenna is expected to remain the largest market for military radars in the forecast period.

|

|

Platform Type Analysis

|

Land, Naval, Airborne, and Space

|

The airborne segment is anticipated to register highest CAGR throughout the forecast period.

|

|

Application Type Analysis

|

Airspace Monitoring & Traffic Management, Maritime Patrolling, Search and Rescue, Air & Missile Defense, Weapon Guidance, Ground Surveillance & Intruder Detection, Airborne Mapping, Navigation, Mine Detection & Underground Mapping, Ground Force Protection & Counter Mapping, Weather Monitoring, Space Situational awareness, and Others

|

The airspace monitoring & traffic management segment accounts for the largest market share in 2024.

|

|

Waveform Type Analysis

|

Frequency Modulated Continuous Wave (FMCW) and Doppler

|

The FMCW accounts for the largest market share in 2024.

|

|

Dimension Type Analysis

|

2D Radars, 3D Radars, And 4D Radars

|

The 3D radars segment accounts for the largest market share in 2024.

|

|

Services Type Analysis

|

Installation/Integration, Support and Maintenance, and Training and Consulting

|

The installation/integration segment will account for the largest market share in 2024.

|

|

Technology Type Analysis

|

Software-Defined Radar (SDR), Quantum Radar, and Conventional Radar

|

The software-defined radar segment account for the largest market share in 2024.

|

|

Band Type Analysis

|

HF/UHF/VHF-band, I-band, S-band, C-band, X-band, Ku-band, Ka-band, Multi-band

|

The HF/UHF/VHF-band segment will account for the largest market share in 2024.

|

|

Range Type Analysis

|

Long Range, Medium Range, Short Range, Very Short Range, Very Long Range

|

The medium-range segment will account for the largest market share in 2024.

|

|

Regional Analysis

|

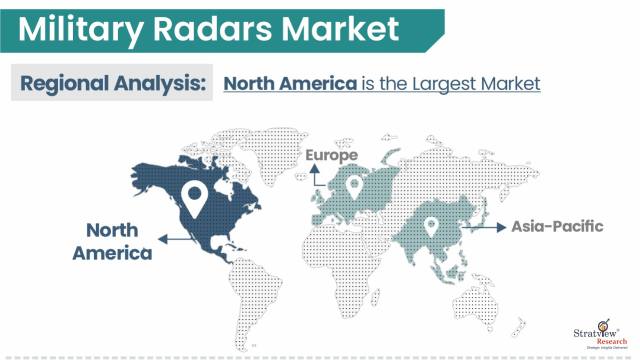

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is likely to maintain its supremacy in the market throughout the forecast period.

|

By Component Type

The market is divided into antennas, transmitters, receivers, power amplifiers, duplexers, digital signal processors, stabilization systems, and graphical user interfaces. Antennas are further subdivided into Parabolic Reflector Antennas, Slotted Waveguide Antennas, Planar Phased Array Antennas, Active Scanned Array Antennas, and Passive Scanned Array Antennas.

The Antenna is expected to remain the largest market for military radars in the forecast period. Due to the increasing demand for military spending in various emerging countries, Antennas play an essential role in detecting and guiding weapons.

By Platform Type

The market is bifurcated into land, naval, airborne, and space. The airborne segment is anticipated to register the highest CAGR throughout the forecast period. Across the world, to detect fighter aircraft and helicopters, Airborne platforms have evolved to support multi-mission warfare machines capable of conducting various missions. Airborne is further sub-segmented into Manned aircraft radars, UAV radars, and aerostat/balloon-based radars.

By Application Type

The market is segmented as airspace monitoring & traffic management, maritime patrolling, search and rescue, air & missile defense, weapon guidance, ground surveillance & intruder detection, airborne mapping, navigation, mine detection & underground mapping, ground force protection & counter-mapping, weather monitoring, space situational awareness, and others.

The airspace monitoring & traffic management segment accounts for the largest market share in 2024, attributed to high-adoption land, airborne, and naval platforms for surface-to-air warfare to engage with main battle tanks and other armored fighting vehicles.

By Waveform Type

The market is segmented as frequency modulated continuous wave (FMCW) and doppler. The FMCW accounts for the largest market share in 2024, the doppler is again segmented into Conventional Doppler and Pulse-Doppler.

By Dimension Type

The market is segmented into 2D radars, 3D radars, and 4D radars. The 3D radar segment accounts for the largest market share in 2024.

By Services Type

The market is segmented as installation/integration, support and maintenance, and training and consulting. The installation/integration segment will account for the largest market share in 2024.

By Technology Type

The market is segmented as software-defined radar (SDR), quantum radar, and conventional radar. The software-defined radar segment accounted for the largest market share in 2024, attributed to the high adoption of new-generation air and missile defense systems.

By Band Type

The market is segmented as HF/UHF/VHF-band, l-band, s-band, c-band, x-band, Ku-band, ka-band, multi-band. The HF/UHF/VHF-band segment will account for the largest market share in 2024.

By Range Type

The market is segmented as long-range, medium-range, short-range, very short-range, and very long-range. The medium-range segment will account for the largest market share in 2024.

Regional Insights

North America is likely to maintain its supremacy in the market throughout the forecast period. Rapid modernization and technological advancements in various sectors have resulted in a high rate of Military Radars systems.

Concurrently, Asia Pacific is expected to witness the fastest military radar market growth during the forecast period. This Asia Pacific region's growth can be attributed to the increasing investments by China, India, and Japan in the defense industry. Globally, China’s defense budget stands second after the US.

Know the high-growth countries in this report. Register Here

Key Players

The following are the major players in the market:

There is stiff competition in the market. The growth of the companies is directly dependent on industry conditions and government support. These companies differentiate their Military Radars based on their quality and penetration in the target and emerging markets.

Also, some major mergers and acquisitions in the industry recently have significantly influenced the competitive dynamics. For example:

- In June 2020, Raytheon signed a contract worth USD 203 million from the US Airforce to provide maintenance services for F-15E aircraft’s active electronically scanned array radar.

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s military radars market realities and future market possibilities for the forecast period of 2025 to 2032. After a continuous interest in our military radars market report from the industry stakeholders, we have tried to further accentuate our research scope to the military radars market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The military radars market is segmented into the following categories:

By Component Type

- Antennas

- Transmitters

- Receivers

- Power amplifiers

- Duplexers

- Digital signal processors

- Stabilization system

- Graphical user interfaces

By Platform Type

- Land

- Naval

- Airborne

- Space

By Application Type

- Airspace monitoring & traffic management

- Maritime patrolling

- Search and rescue

- Air & missile defense

- Weapon guidance

- Ground surveillance & intruder detection

- Airborne mapping

- Navigation

- Mine detection & underground mapping

- Ground force protection & counter-mapping

- Weather Monitoring

- Space situational awareness

By End-User Type

- Navy

- Army

- Air force

- Space

By Waveform Type

- Frequency modulated continuous wave (FMCW)

- Doppler

By Technology Type

- Software-defined radar (SDR)

- Quantum radar

- Conventional radar

By Frequency Band Type

- hf/uhf/vhf-band

- I-band

- S-band

- C-band

- X-band

- Ku-band

- Ka-band

- Multi-band

By Range Type

- Long range

- Medium range

- Short range

- Very short range

- Very long range

By Product Type

- Surveillance and airborne early warning radar

- Tracking & fire control radar

- Multi-function radar

- Weapon locating & cram radar

- Aircraft bird strike avoidance radar

- Ground penetrating radar

- Air traffic control radar

- Airborne moving target indicator

- Weather radar

- counter-drone radar

By Dimension Type

- 2D radars

- 3D radars

- 4D radars

By Services Type

- Installation/Integration

- Support and maintenance

- Training and consulting

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, India, Australia, South Korea, and Rest of Asia-Pacific

- Rest of the World (Country Analysis: Saudi Arabia, Brazil, and Others)

Click Here, to learn the market segmentation details.

Report Customization Options

Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].