Market Insights

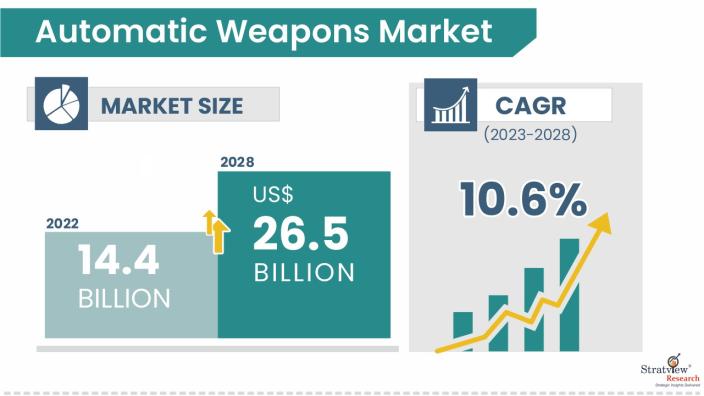

The automatic weapons market was estimated at USD 14.4 billion in 2022 and is likely to grow at a CAGR of 10.6% during 2023-2028 to reach USD 26.5 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Automatic weapons are semi-automatic and fully automatic firearm combinations. Automatic weapons fire constant rounds if the gun trigger is hard-pressed or if there is ammo in the chamber. Automatic weapons have instigated a change in war engagement & defense strategies owing to their vast range of characteristics.

Recent cross-border disputes amongst nations such as Turkey & Cyprus, India & Pakistan, and Russia & Ukraine have resulted in provincial conflicts and intensified emphasis on advanced weapons. Because of regional differences, countries spend huge amounts on the development of weapons, therefore driving the growth of the automatic weapons market.

Market Drivers

The automatic weapons market is driven by a host of factors, some of which are noted below:

Demand for precision strike weapons: Demand for precision strike weapons that reduce collateral damage and constant fear of national security. Automatic weapons can be equipped with advanced targeting systems that allow for more precise strikes, which can help to reduce civilian casualties and property damage. This is particularly important in unstable economies, where there may be a high risk of collateral damage. For example, by September 2021, the U.S. Navy confirmed an agreement with Northrop Grumman Corp. to manufacture the AGM-88G Advanced Anti-Radiation Guided Extended-Range Missile.

A constant rise in the defense budget of many countries and increased spending on upgrade technology: Global defense spending is on the rise, and many countries are investing in new and upgraded weapons systems. This includes automatic weapons, which are essential for modern militaries.

Constant fear of national security: The world is a volatile place, and many countries face a constant threat of national security breaches. This fear drives governments to invest in military capabilities, including automatic weapons.

Advancements in technology: Automatic weapons are becoming increasingly sophisticated and technologically advanced. This makes them more effective and reliable, which is driving demand in the market.

Increased urbanization: As the world becomes more urbanized, there is an increasing need for weapons that can be used in close-quarters combat. Automatic weapons are well-suited for this type of warfare, which is driving demand in the market.

Restraining Factors

- Unfavorable government regulations: Many countries have strict laws and regulations governing the ownership and sale of automatic weapons. These regulations can make it difficult and expensive for companies to sell automatic weapons, and they can also limit the number of potential customers.

- High purchase costs: Automatic weapons are typically more expensive than other types of firearms. This is because they are more complex to manufacture, and they require specialized components. The high purchase cost of automatic weapons can deter some potential customers from buying them.

- Standardization of automatic weapons: Many countries are standardizing their militaries on a small number of automatic weapons. This is making it easier for companies to produce and sell automatic weapons, and it is also reducing the costs associated with maintenance and training.

Opportunities

Global militaries are seeking advanced automatic weapons systems for tactical advantage in combat, leading to increased accuracy, range, and lethality. Companies in the automatic weapons market are investing heavily in research and development to develop these systems, driven by the growing threat of terrorism and violent crimes, including law enforcement agencies and private security companies.

Key Challenges

The automatic weapons market is a growing and expanding sector with significant growth opportunities, but it faces challenges due to strict government regulations and rising public awareness about gun violence. Companies in this market face increasing competition from emerging markets, which can produce automatic weapons at lower costs than established companies in developed markets. Despite these challenges, the market remains a significant opportunity for companies to expand and thrive in the ever-evolving firearms industry.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Caliber Type Analysis

|

Small Caliber, Medium Caliber, and Large Caliber

|

Small-caliber segment is expected to dominate due to its enhanced performance, penetration range, and lethality.

|

|

Product Type Analysis

|

Automatic Rifle, Machine Gun, Automatic Launchers, Automatic Cannon, and Gatling Gun

|

The automatic rifles segment held the largest market share in 2022 and is expected to propel market growth at a significant rate during forecast period.

|

|

End-User Type Analysis

|

Land, Maritime, And Airborne

|

Land segment dominated the market with the highest share in 2022.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America will likely maintain its supremacy in the market throughout the forecast period.

|

By Caliber Type

"Small-caliber segment is expected to dominate due to its enhanced performance, penetration range, and lethality."

The market is segmented into small, medium, and large calibers. The small-caliber segment is expected to dominate due to its enhanced performance, penetration range, and lethality. Medium calibers, such as 20mm, 25mm, 30mm, and 40mm, are expected to show significant CAGR due to their multipurpose ammunition with tracer capabilities. The large-caliber segment is expected to show significant growth due to innovations in large-caliber machine guns, increasing the range and accuracy of these weapon systems.

By Product Type

"Automatic rifles segment held the largest market share in 2022."

The market is divided into automatic rifles, machine guns, automatic launchers, automatic cannons, Gatling guns, and others. The automatic rifles segment held the largest market share in 2022 and is expected to propel market growth at a significant rate during the review period. Automatic rifles constantly fire till the last round of ammo; however, semi-automatic or self-loading rifles need to press the gun trigger after each shot. Semi-automatic rifles are selected as compared to automatic rifles as such rifles extend higher precision.

By End-user Type

"Land segment dominated the market with the highest share in 2022."

The market is segmented into land, maritime, and airborne. The land segment dominated the market with the highest share in 2022 and is projected to show continued demand shortly due to the rapid expansion of military forces worldwide, along with a rise in the procurement of automatic weapons by land-based forces. The increasing demand for automatic weapons is mainly attributed to numerous factors, including the requirement for connected warfare systems, the upgradation of existing armored platforms, rising emphasis on close combat systems, and the safety of soldiers in war-like situations, among others. The airborne is projected to grow exponentially during the forecast period owing to the rising demand for GPS-guided weapons operating smoothly even during bad weather conditions.

Regional Insights

"North America will likely maintain its supremacy in the market throughout the forecast period."

North America will likely maintain its supremacy in the automatic weapons market throughout the forecast period. This is mostly due to the high defense budget and spending to strengthen the armed forces. The spending is mainly for procuring advanced weapons and upgrading the defense fleet with innovative weapons. Furthermore, the presence of major market players contributes to the growth.

Concurrently, Asia Pacific is expected to witness the fastest growth in the global automatic weapons market during the forecast period. The key factors responsible for the swift growth are increased demand for body armor by the military and a rise in overall military expenditure (especially in China and India). The increased defense and individual spending on security in countries such as China and India inject huge growth prospects for the market in the Asia Pacific region.

Know the high-growth countries in this report. Register Here

Key Players

The following are the key players in the automatic weapons market:

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

There is stiff competition in the market. The growth of the companies is directly dependent on industry conditions and government support. These companies differentiate their smart weapon offerings based on their quality and penetration in the target and emerging markets.

Some major mergers and acquisitions in the industry recently have significantly influenced the competitive dynamics. For example:

- In July 2020, BAE Systems acquired the Collins Aerospace Military Global Positioning System from Raytheon Technologies Corp. The deal enhances BAE System’s existing electronic systems business portfolio by including Raytheon’s anti-spoofing and anti-jamming technology that allows accurate navigation across various defense missions.

- In January 2019, Germany’s GIWS, a joint venture between Rheinmetall and Diehl Defence, confirmed its relaunch of SMArt 155 artillery projectile to be undertaken between 2022 and 2024.

- Rafael introduced “firefly,” miniature loitering ammunition, in June 2018. The small ammunition could be used in conjunction with an electro-optical precision integration kit to deliver precision guidance to surface-to-surface multiple rocket launch systems and could also be used by dismounted soldiers.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market, covering 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The automatic weapons market is segmented into the following categories:

By Caliber Type

- Small Caliber

- Medium Caliber

- Large Caliber

By Product Type

- Automatic Rifle

- Machine Gun

- Automatic Launchers

- Automatic Cannon

- Gatling Gun

By End-User Type

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, India, Australia, South Korea, and the Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Saudi Arabia, Brazil, and Others)

Research Methodology

- This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s automatic weapons market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].

Recent Developments

Several developments in the defense industry have been directed at automatic weapons in recent years, which would boost the overall market. Some of them are:

In May 2022, Saab, a defense giant, and its armed forces partners completed a two-day series of live-fire demonstrations, including night-time firings, the largest demonstration at the company’s facilities since 2014. With Sweden formally petitioning to join NATO after decades of balancing the alliance and Russia, a new spotlight is being cast on its domestic defense industry.

One of the utilities of the Saab-designed weapons is that they exit the launcher tube, and the rocket motor ignites only after initially airborne. This “shoot and scoot” capability of the system makes it possible for the troops firing the weapon not to reveal their position — a weakness of several previous-generation ATGMs (Anti-tank guided mission, smart weapon).

January 2021 – MBDA signed a contract with the UK Ministry of Defense to equip a new mini spear 3 network-enabled cruise missile for its F-35B combat Jets. The value of the contract was worth US$ 750mn.

Feb 2021- Lockheed Martin signed a contract worth US$ 414mn with the US Navy and Airforce to supply LRASM, an anti-ship, precision-guided standoff missile based on the successful joint air-to-ground standoff missile.

In February 2020, U.S.-based General Dynamics Corp. was awarded a US$ 883 Million contract to modernize the U.S. army training program. The contract includes improving the Army’s individual and collective expeditionary training systems and major combat training centers.

In February 2020, Israel Aerospace Industries Ltd. was awarded a US$ 240 million contract for the replacement of T-38 trainer aircraft wings.