Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Military GPS Receivers Market

-

The annual demand for military GPS receivers was USD 648.2 million in 2024 and is expected to reach USD 691.7 million in 2025, up 6.7% than the value in 2024.

-

During the forecast period (2025 to 2030), the military GPS receivers market is expected to grow at a CAGR of 4.8%. The annual demand will reach of USD 875.3 million in 2030.

-

During 2025-2030, the military GPS receivers industry is expected to generate a cumulative sales opportunity of USD 4733.40 million.

High-Growth Market Segments:

-

North America is expected to remain the largest market over the next five years, whereas Asia-Pacific is likely to grow at the fastest rate.

-

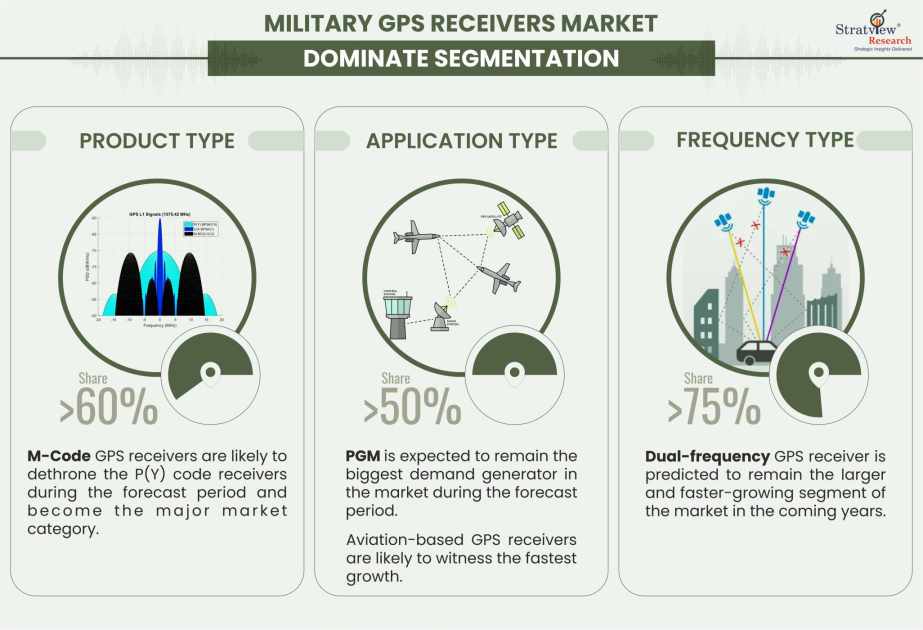

By Product type, M-Code GPS Receivers are likely to be the dominant type in the market during the forecast period.

-

By Frequency type, Dual-Frequency GPS Receivers are likely to maintain their market dominance in the coming years

-

By Application type, PGM is expected to remain the biggest demand generator in the market during the forecast period.

Market Statistics

Have a look at the sales opportunities presented by the military GPS receivers market in terms of growth and market forecast.

|

Military GPS Receivers Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Million)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 604.9 million

|

-

|

|

Annual Market Size in 2024

|

USD 648.2 million

|

YoY Growth in 2024: 7.2%

|

|

Annual Market Size in 2025

|

USD 691.7 million

|

YoY Growth in 2025: 6.7%

|

|

Annual Market Size in 2030

|

USD 875.3 million

|

CAGR 2025-2030: 4.8%

|

|

Cumulative Sales Opportunity during 2025-2030

|

USD 4733.40 million

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 518 million+

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 324 million to 454 million

|

50% - 70%

|

Market Dynamics

Introduction:

What are military GPS receivers?

Military GPS receivers are specialized navigation devices designed for military applications. They are equipped with features and capabilities tailored to meet the unique requirements and challenges of military operations. GPS receivers possess a set of specialized properties that distinguish them from commercial GPS receivers, such as enhanced security, anti-jamming capability, selective availability anti-spoofing module (SAASM), high precision, anti-spoofing, and anti-jamming antennas.

The usage of military GPS receivers is expanding worldwide as several military missions and operations rely heavily on the transmission of real-time data, thereby augmenting the overall industry's growth. These GPS-enabled devices provide accurate target tracking and route navigation and offer precise digital mapping solutions. They have become indispensable to military forces, enabling precise tracking and targeting for armed troops and units.

Market Drivers:

-

Rising Demand for Precision Navigation and Positioning in Modern Warfare: The increasing complexity of military operations necessitates highly accurate and reliable navigation systems. Military GPS receivers provide critical positioning, navigation, and timing (PNT) services for troops, vehicles, aircraft, and unmanned systems. Advancements in GPS technology and integration with other sensors are driving market expansion as armed forces seek improved situational awareness.

-

Growing Adoption of Unmanned Aerial Vehicles (UAVs) and Autonomous Systems; The widespread deployment of UAVs and autonomous platforms in surveillance, reconnaissance, and combat roles is boosting demand for advanced military GPS receivers. These receivers enable precise route planning, target tracking, and mission execution, supporting enhanced operational effectiveness.

-

Technological Advancements Enhancing GPS Receiver Capabilities: Innovations such as anti-jamming, anti-spoofing features, multi-constellation compatibility (GPS, GLONASS, Galileo, BeiDou), and miniaturization are improving the resilience and accuracy of military GPS receivers. These enhancements enable reliable operation in contested or degraded environments, which is critical for modern defense applications.

-

Increasing Defense Spending and Modernization Programs Globally: Rising defense budgets, especially in North America, Asia-Pacific, and Europe, are driving the modernization of military hardware, including upgrading navigation systems with next-generation GPS receivers. Investments in next-gen battlefield technologies and network-centric warfare concepts are expected to sustain demand for advanced GPS receivers.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Product-Type Analysis

|

P(Y) Code GPS Receivers and M-Code GPS Receivers

|

M-Code GPS receivers are likely to dethrone the P(Y) code receivers during the forecast period and become the major market category.

|

|

Frequency-Type Analysis

|

Single-Frequency GPS Receivers and Dual-Frequency GPS Receivers

|

Dual-frequency GPS receiver is predicted to remain the larger and faster-growing segment of the market in the coming years.

|

|

Application-Type Analysis

|

Aviation-Based GPS Receivers, Ground-Based GPS Receivers, PGM-Based GPS Receivers, Handheld GPS Receivers, and Maritime Equipment-Based GPS Receivers

|

PGM is expected to remain the biggest demand generator in the market during the forecast period. Aviation-based GPS receivers are likely to witness the fastest growth.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is expected to remain the largest market over the next six years whereas Asia-Pacific is likely to grow at the fastest rate.

|

By Product Type

“M-Code GPS receivers are likely to dethrone the P(Y) code receivers during the forecast period and become the major market category”.

-

The military GPS receiver market is segmented into P(Y) Code GPS receivers and M-code GPS receivers. Ever since the commencement of the sales of M-Code GPS receivers, their sales have been increasing exponentially, eroding the market share of the traditionally used P(Y) Code receivers.

-

These advanced devices are designed to enhance the PNT capabilities of armed units and provide improved resistance to existing and emerging threats to GPS, such as jamming and spoofing. Therefore, it is estimated that the M-Code GPS receivers will completely replace the P(Y) Code receivers in the coming decade.

By Frequency Type

“Dual-frequency GPS receiver is predicted to remain the largest and fastest-growing segment of the market in the coming years”.

-

The market is segmented into single-frequency GPS receivers and dual-frequency GPS receivers. Dual-frequency GPS receivers are preferred over their single-frequency counterparts due to their greater accuracy and resistance to multipath errors, which are common for the latter.

-

Furthermore, if either of the two frequencies fails, the other one works as a backup, thus ensuring uninterrupted signal transmission.

Want to get more details about the segmentations? Register Here

By Application Type

“PGM-based GPS receivers are expected to remain the biggest demand generator in the market during the forecast period. Aviation-based GPS receivers are likely to witness the fastest growth”.

-

The military GPS receiver market is segmented into aviation-based GPS receivers, ground-based GPS receivers, PGM-based GPS receivers, handheld GPS receivers, and maritime equipment-based GPS receivers.

-

Among these application types, the PGM-based application is estimated to remain the market leader for military GPS receivers in the coming years, as these GPS systems form an essential component in the PGMs (such as missiles, bombs, and projectiles). Moreover, with the increasing hostilities across the globe, the demand for PGMs has been increasing manifold, thereby fueling the market growth.

Regional Analysis

“North America is expected to remain the largest market over the next six years, whereas Asia-Pacific is likely to grow at the fastest rate”.

-

In terms of regions, North America is likely to remain the largest market for military GPS receivers over the forecast period, with the USA accounting for the majority of the market. The country has been extensively investing in military GPS receivers to enhance the overall capabilities of its armed forces.

-

Furthermore, market-leading companies, such as BAE Systems, L3Harris Technologies, Inc., and RTX Corporation, are present in the region, giving North America an unrivaled advantage over other regions.

Want to know which region offers the best growth opportunities? Register Here

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the military GPS receivers market -

-

General Dynamics Corporation

-

Hertz Systems

-

Israel Aerospace Industries

-

Juniper Systems, Inc.

-

L3Harris Technologies, Inc.

-

Mayflower Communications

-

RTX Corporation (Raytheon)

-

Thales Group

-

Trimble Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

-

In January 2024, BAE Systems completed CDR (Critical Design Review) for its Military GPS User Equipment (MGUE) Increment 2 Miniature Serial Interface (MSI) program. This development is part of a US$247 million contract awarded in 2020 by the U.S. Space Force.

-

In November 2023, BAE Systems was selected to enhance GPS technology on the Eurofighter Typhoon. The fighter is to receive a digital GPS anti-jam receiver and a new GEMVII-6 airborne digital GPS receiver.

-

In September 2023, BAE Systems signed a five-year contract worth US$319 million with the Defense Information Systems Agency (DISA), for the development of Miniature PLGR Engine-M-code (MPE-M) receiver cards.

-

In June 2023, BAE Systems unveiled NavGuide, a next-generation assured-positioning, navigation, and timing (A-PNT) device featuring M-Code GPS technology.

-

In August 2021, BAE Systems unveiled its ultra-small MicroGRAM-M GPS receiver, which is compatible with M-Code signals that are resistant to both jamming and spoofing. These GPS receivers have been developed for the armed troops and integrated into small UAVs.

-

In September 2021, Collins Aerospace unveiled the MUNS GPS receiver, a military underwater navigation system that provides the diver with precise position and includes secure anti-jamming capabilities during deep-sea missions.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2030

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2030

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

4 (Product Type, Frequency Type, Application Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The military GPS receivers market is segmented into the following categories.

By Product Type

-

P(Y) Code GPS Receivers

-

M-Code GPS Receivers

By Frequency Type

By Application Type

-

Aviation-Based GPS Receivers

-

Ground-Based GPS Receivers

-

PGM-Based GPS Receivers

-

Handheld GPS Receivers

-

Maritime Equipment-Based GPS Receivers

By Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

-

Asia-Pacific (Country Analysis: China, India, Australia, South Korea, and the Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Saudi Arabia, Brazil, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s military GPS receivers market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]