Aircraft Sensors Market Insights

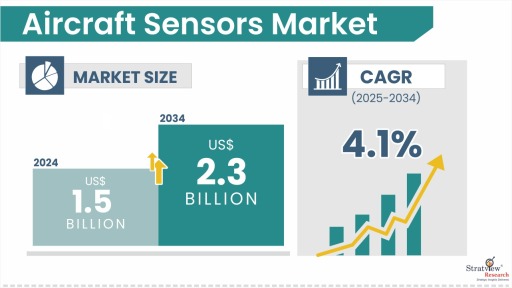

"The global aircraft sensors market size was US$ 1.5 billion in 2024 and is likely to grow at a decent CAGR of 4.1% in the long run to reach US$ 2.3 billion in 2034."

Want to get a free sample? Register Here

Introduction

Aircraft sensors are highly specialized devices designed to detect, measure, and relay crucial data about various physical parameters that are essential for the safe and efficient operation of an aircraft. These parameters include temperature, pressure, speed, position, altitude, angle of attack, vibration, and fluid levels. Found in systems that range from engines and avionics to environmental control and landing gear, these sensors provide real-time feedback to pilots and onboard computers, which helps in making informed decisions and adhering to strict safety regulations. Today’s aircraft sensors often utilize cutting-edge technologies like micro-electromechanical systems (MEMS), fiber optics, and wireless data transmission, ensuring high accuracy, lightweight design, and impressive durability even in extreme conditions.

The global market for aircraft sensors is experiencing steady growth, driven by the increasing production rates of aircraft, the growing popularity of next-generation models, and the enhanced integration of advanced avionics and automation systems. Fleet modernization initiatives and the rise of unmanned aerial vehicles (UAVs) are also boosting the demand for compact, high-performance sensors. Moreover, regulatory requirements for improved safety, operational efficiency, and environmental compliance are pushing manufacturers to create sensors that offer greater precision, quicker response times, and enhanced reliability. With innovations like IoT-enabled smart sensors and predictive maintenance capabilities becoming more common, the aircraft sensors market is set for significant changes in the years ahead.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Platform-Type Analysis

|

Commercial Aircraft, Regional Aircraft, General Aviation, Helicopter, Military Aircraft, Spacecraft, and UAV.

|

Commercial aircraft are likely to continue leading as the dominant platform type in the aircraft sensors market.

|

|

Sensor-Type Analysis

|

Pressure Sensors, Temperature Sensors, Position Sensors, Inertial Sensors, Force/Torque Sensors, and Other Sensors

|

Pressure Sensors are expected to remain the most extensively utilized sensor type throughout the forecast period.

|

|

Application-Type Analysis

|

Engine, Surface, Landing Gear, Brakes & Wheels, Flight Control Systems, Cabin, Cargo & Environmental Control System, and Other Applications

|

Engine applications are forecasted to continue representing the primary application category for aircraft sensors throughout the forecast period.

|

|

End-User-Type Analysis

|

OE and Aftermarket

|

Original Equipment (OE) is projected to maintain its standing as both the larger and faster-growing end-user of the market.

|

|

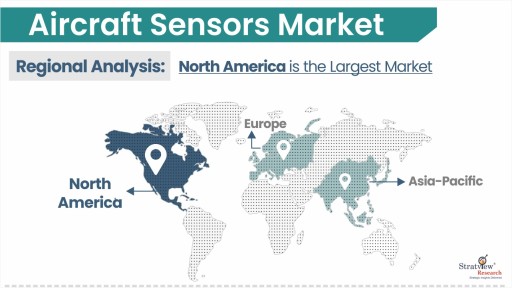

Regional Analysis

|

North America, Europe, Asia-Pacific, and the Rest of the World

|

North America is expected to remain the largest regional market for aircraft sensors in the coming years.

|

By Platform Type

“Commercial aircraft is likely to continue leading the market, while also maintaining the fastest growth during 2025-2034.”

The market is segmented into commercial aircraft, regional aircraft, general aviation, helicopter, military aircraft, spacecraft, and UAV. Commercial aircraft account for the largest share of demand in the aircraft sensors market due to sustained growth in global passenger traffic, large-scale production of fuel-efficient narrowbody and widebody models, and stringent safety and performance regulations that require extensive sensor integration. Modern commercial jets such as the Airbus A350, Boeing 787, and A320neo family incorporate hundreds of sensors covering functions from engine health monitoring and fuel management to cabin pressure control and structural health assessment. The move toward more-electric aircraft has further increased the reliance on sensors for replacing mechanical systems with electronically controlled alternatives.

Commercial aircraft are also the fastest-growing category, driven by record order backlogs of over 14,941 units combined for Airbus and Boeing as of 2025 and rising adoption of smart, IoT-enabled sensors for predictive maintenance. These advanced sensors allow real-time health monitoring of critical systems, reducing unscheduled downtime and lowering lifecycle costs. Furthermore, the ongoing replacement of aging fleets in North America and Europe, coupled with rapid fleet expansion in the Asia-Pacific region, is accelerating demand for sensor-rich aircraft platforms. This dual push from new deliveries and aftermarket retrofits solidifies commercial aviation as both the largest and fastest-expanding category of the aircraft sensors market. Highlighting this shift, modern aircraft programs are becoming increasingly sensor-dense. For instance, new Airbus airliners will have up to 10,000 sensors along their wings alone, plus an undetermined quantity in other flight systems.

By Sensor Type

“Pressure sensors are set to dominate the market landscape, with temperature sensors achieving the fastest growth trajectory in the coming years.”

Based on sensor type, the market is segmented into pressure sensors, temperature sensors, position sensors, inertial sensors, force/torque sensors, and other sensors. Pressure sensors hold the dominant share in the aircraft sensors market due to their critical role in multiple aircraft systems, including pitot-static systems for airspeed and altitude measurement, engine oil and hydraulic pressure monitoring, cabin pressurization control, and fuel system management. In both commercial and military aircraft, these sensors are indispensable for ensuring flight safety and operational efficiency, with built-in redundancy to guarantee fail-safe performance. The rise of digital pressure transducers, known for their higher accuracy and self-diagnostic features, has solidified their status as a fundamental sensor type. For instance, next-gen air data systems in aircraft like the Boeing 787 utilize multiple redundant pressure sensing units to boost safety and performance in different atmospheric conditions.

On the other hand, temperature sensors are set to experience the fastest growth, driven by the increasing need for real-time thermal monitoring in engines, environmental control systems, avionics cooling, and battery management for electric and hybrid aircraft. Modern turbofan engines operate at turbine inlet temperatures that exceed 1,600°C, which means we need advanced thermocouples and resistance temperature detectors (RTDs) that can handle extreme conditions while still being precise. The push for predictive maintenance programs is also driving this trend, as temperature sensors are essential for spotting early signs of component wear or overheating. Additionally, the rise of electric aircraft and UAV platforms, both of which rely heavily on accurate temperature monitoring for their energy systems, is speeding up the adoption of compact, high-response thermal sensors.

By Application Type

“Engines will likely continue to be the primary driver of demand, while flight control systems are projected to witness the fastest growth during the forecast period.”

Based on the application type, the market is segmented into engine, surface, landing gear, brakes & wheels, flight control systems, cabin, cargo & environmental control systems, and other applications. Engines remain the primary driver of demand for aircraft sensors due to their dependence on a variety of sensing technologies that ensure safe, efficient, and compliant operations. Modern turbofan engines like the CFM LEAP and Pratt & Whitney GTF integrate hundreds of sensors to monitor parameters such as oil and fuel pressure, turbine inlet temperature, exhaust gas temperature, vibration, and airflow. These sensors continuously send real-time data to the engine control units (ECUs), helping to optimize performance, cut down on fuel consumption, and avoid component failures. As the industry pushes for higher bypass ratios and hotter operating cycles in next-gen engines, the need for sensors that can reliably operate under extreme pressures and temperatures has only grown. Plus, with the rise of full-authority digital engine control (FADEC) systems, the number and sophistication of sensors have skyrocketed, making the engine segment the biggest user of advanced sensing technologies.

On the other hand, flight control systems are expected to expand rapidly, driven by the global shift towards fly-by-wire systems and increasing automation in both commercial and military aircraft. Sensors like position, force, and pressure transducers play a vital role in monitoring pilot inputs, actuator movements, and aerodynamic loads in real time. The increasing complexity of control surfaces, especially in more-electric aircraft, requires highly responsive and redundant sensor networks to guarantee safety and precision. Moreover, emerging aircraft concepts such as eVTOLs and advanced UAVs heavily depend on sensor-driven control systems for stability and maneuverability, which is ramping up the demand for innovative, lightweight, and low-power sensors in this segment.

By End-User Type

“OE is projected to sustain its dominance while also registering the fastest growth throughout the forecast period.”

The OE is still the leading end-user of the aircraft sensors market. Every new aircraft that rolls off the production line comes packed with a vast array of sensors integrated into everything from engines and avionics to flight controls, landing gear, fuel systems, and environmental control systems. With modern commercial jets often featuring hundreds of sensors, OE installations are a key factor driving market value. The increasing production rates of popular models like the Airbus A320neo family, Boeing 737 MAX, and COMAC C919, along with significant military procurement programs such as the KC-46A tanker, are helping to maintain this stronghold.

OE is also the fastest-growing category, fueled by the record aircraft order backlogs and the rapid adoption of cutting-edge sensing technologies. We're seeing advancements like MEMS-based miniaturized sensors, fiber-optic systems, and IoT-enabled smart sensors. These innovations are boosting the number of sensors on each aircraft and increasing their individual value, which in turn is driving revenue growth in the OE market. Plus, the emergence of next-generation aircraft platforms, including electric and hybrid-electric models, is creating a need for tailored sensor solutions, further fueling demand in the OE category for the foreseeable future.

Regional Analysis

“North America will continue to be the largest regional market, while Asia-Pacific is projected to witness the highest growth rate over the forecast period.”

North America is expected to remain the largest market for aircraft sensors during the forecast period, underpinned by its position as the world’s leading aerospace manufacturing hub. The region is home to major OEMs like Boeing, Lockheed Martin, Raytheon Technologies, and GE Aerospace, along with a robust network of NADCAP-approved sensor facilities. The high production rates of commercial aircraft, cutting-edge military programs like the F-35, B-21 Raider, and KC-46, along with a strong demand for Brakes & Wheels services, keep the sensors industry highly active. The region also leads in technological innovation, including the integration of automation, Industry 4.0 monitoring, and environmentally friendly processing techniques.

Whereas, the Asia-Pacific region is expected to be the fastest-growing area, fueled by a rapid increase in aircraft manufacturing capacity, rising defense budgets, and the localization of supply chains. Countries such as China, India, and Japan are making significant investments in both original equipment (OE) and Brakes & Wheels capabilities, backed by homegrown aircraft programs like the COMAC C919, HAL Tejas, and Mitsubishi SpaceJet, as well as major fleet expansions. Moreover, international processors are establishing NADCAP-approved facilities in this region to cater to the surging demand, similar to the investments made by Bodycote and PCC in China and Singapore.

Want to get a free sample? Register Here