Market Insights

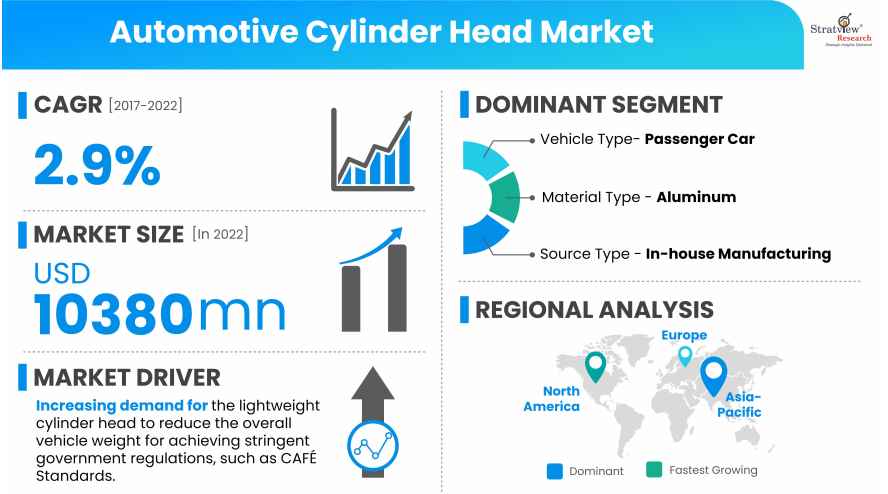

"The global automotive cylinder head market was valued at US$ 8,737 million in 2016 and is likely to grow at a CAGR of 2.9% over the next five years to reach US$ 10,380 million in 2022."

Want to get a free sample? Register Here

|

Automotive Cylinder Head Market Report Overview

|

|

Market Size in 2022

|

USD 10,380 Million

|

|

Market Growth (2017-2022)

|

CAGR of 2.9%

|

|

Base Year of Study

|

2016

|

|

Trend Period

|

2011-2015

|

|

Forecast Period

|

2017-2022

|

Market Drivers

Organic growth in the automobile production, owing to increasing disposable income and growing urbanization and increasing demand for the lightweight cylinder head to reduce the overall vehicle weight for achieving stringent government regulations, such as CAFÉ Standards, are the major growth drivers of the global automotive cylinder head market.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Vehicle-Type Analysis

|

Passenger Car, LCV and M&HCV

|

The passenger car is expected to remain the dominant segment of the global automotive cylinder head market during the forecast period of 2017 to 2022.

|

|

Material-Type Analysis

|

Aluminum and Iron

|

Aluminum is projected to remain the most dominant material type in the global automotive cylinder head market over the next five years.

|

|

Source-Type Analysis

|

In-house Manufacturing and Independent Manufacturing

|

In-house manufacturing is expected to remain the largest segment of cylinder head market in the global automotive industry over the next five years.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Asia-Pacific is expected to remain the largest cylinder head market during the forecast period.

|

By Vehicle Type

"The passenger car segment accounted for the largest market share."

The global automotive cylinder head market is firstly segmented based on vehicle type as passenger car, LCV, and M&HCV. The passenger car is expected to remain the dominant segment of the global automotive cylinder head market during the forecast period of 2017 to 2022, driven by higher production of passenger cars than LCVs and MHCVs. The vehicle type is also likely to witness the highest growth during the same period.

By Material Type

"The aluminum segment accounted for the largest market share."

The global automotive cylinder head market is segmented as aluminum cylinder head and iron cylinder head. Aluminum is projected to remain the most dominant material type in the global automotive cylinder head market over the next five years. There would be a continuous shift from iron to aluminum cylinder heads because of several factors including lightweight. Stringent regulations imposed by governments of many countries are putting pressure on the automakers to curb the overall vehicle weight to increase fuel efficiency or reduce emissions. Cylinder head could not escape itself from such regulations and experienced a significant change in the selection of materials over the period. The auto industry is rapidly moving towards lightweight materials in most of its components including cylinder head to make the final component light in weight without sacrificing overall performance.

By Source Type

"The in-house manufacturing segment accounted for the largest market share."

The global automotive cylinder head market is segmented as in-house manufacturing and independent manufacturing. In-house manufacturing is expected to remain the largest segment of cylinder head market in the global automotive industry over the next five years, whereas Independent manufacturing is likely to remain the fastest-growing segment during the same period. All the leading auto OEMs, such as General Motors Company, Ford Motor Company, Toyota Motor Corporation, and Volkswagen AG, are manufacturing cylinder heads in-house for most of their engine models.

Regional Insights

"Asia-Pacific accounted for the largest market share."

Asia-Pacific is expected to remain the largest cylinder head market during the forecast period. The region is also expected to experience the highest growth during the same period. Increasing automobile production, especially passenger car is driving the demand for cylinder head in the region. Europe is expected to remain the second largest automotive cylinder head market during the same period.

Want to get a free sample? Register Here

Key Players

The supply chain of this market comprises raw materials suppliers, cylinder head manufacturers, distributors, automotive OEMs, and dealers.

The key automotive cylinder head manufacturers are-

Developing lightweight aluminum cylinder head, executing mergers & acquisitions, and forming long-term contracts with OEMs are the key strategies adopted by the major players to gain a competitive edge in the market.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s automotive cylinder head market realities and future market possibilities for the forecast period. The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report, from Stratview Research, studies the global cylinder head market in the automotive industry over the period 2017 to 2022. The report provides detailed insights into the market dynamics to enable informed business decision making and growth strategy formulation based on the opportunities present in the market.

What Deliverables Will You Get in this Report?

|

Key questions this report answers

|

Relevant contents in the report

|

|

How big is the sales opportunity?

|

In-depth Analysis of the Automotive Cylinder Head Market

|

|

How lucrative is the future?

|

Market forecast and trend data and emerging trends

|

|

Which regions offer the best sales opportunities?

|

Global, regional, and country-level historical data and forecasts

|

|

Which are the most attractive market segments?

|

Market Segment Analysis and Forecast

|

|

Which are the top players and their market positioning?

|

Competitive landscape analysis, Market share analysis

|

|

How complex is the business environment?

|

Porter’s five forces analysis, PEST analysis, Life cycle analysis

|

|

What are the factors affecting the market?

|

Drivers & challenges

|

|

Will I get the information on my specific requirement?

|

10% free customization

|

The Automotive Cylinder Head Market is segmented in the following ways:

By Vehicle Type:

By Material Type:

- Aluminum Cylinder Head

- Iron Cylinder Head

By Source Type:

- In-house Manufacturing

- Independent Manufacturing

By Region:

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, Italy, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Argentina, and Others)

Want to get a free sample? Register Here

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].