Market Insights

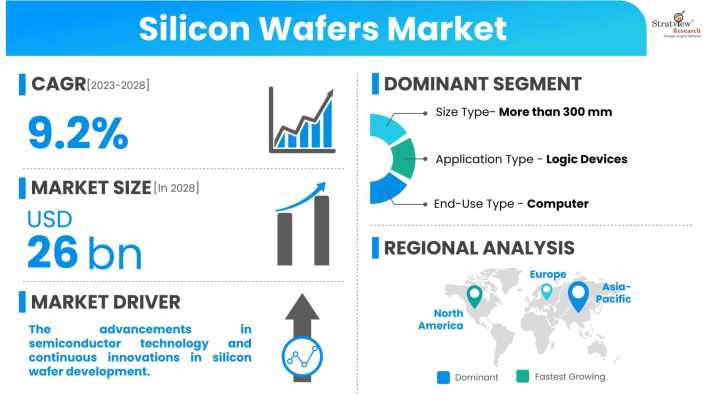

The silicon wafers market was estimated at USD 18.6 billion in 2022 and is likely to grow at a CAGR of 9.2% during 2023-2028 to reach USD 26 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Silicon wafers serve as the foundational substrate in the semiconductor industry. They are used to produce integrated circuits, transistors, power semiconductors, and electromechanical and acoustic microsystems. These semiconductors are integral to applications, such as electric vehicles and 5G networks, where optimizing energy efficiency stands as a paramount priority.

Market Drivers

The advancements in semiconductor technology and continuous innovations in silicon wafer development are mainly driven by the evolving demand for a wide array of advanced electronic products, such as smartphones, tablets, and laptops.

In this landscape, consumers pursue increasingly powerful, energy-efficient, compact, aesthetically refined, and feature-enriched devices, with heightened expectations for enhanced computing performance, superior graphic capabilities, and advanced connectivity features. The integral role of advanced silicon wafers lies in their ability to facilitate the integration of more transistors and components, thereby enabling the realization of these sought-after functionalities.

The continued expansion of the semiconductor industry is driven by several pivotal factors, such as the rising demand for memory and logic devices to cope with the substantial influx of data in the era of the Internet of Things (IoT) and big data.

Additionally, the increasing need for a diverse range of sensors for enhancing safety in automotive assistance and enabling autonomous driving; and the need for power management devices for improving energy efficiency, are boosting the demand for advanced silicon wafers.

Some of the most Recent Market JVs and Acquisitions:

Over the past few years, there have been a fair number of strategic alliances, including M&As, JVs, etc., across the globe. Among them, the recent one is, in June 2022, Diodes Incorporated announced the acquisition of Onsemi’s wafer fabrication facility and operations located in South Portland, Maine, the USA (“SPFAB”).

Want to have a closer look at this market report? Click Here

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

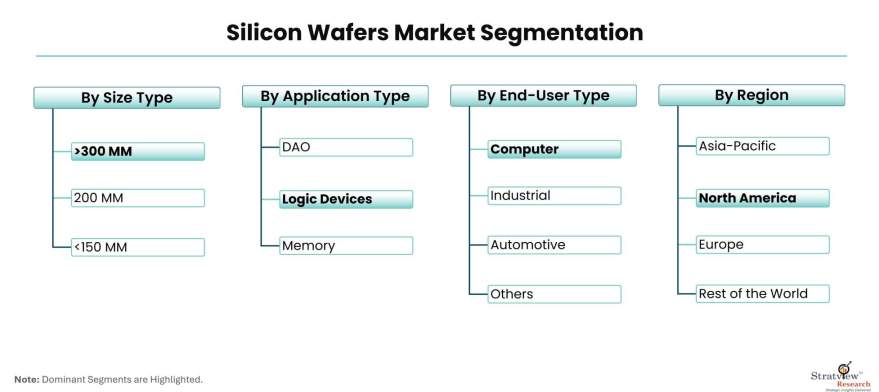

Size Type Analysis

|

Less than 150 mm, 200 mm, and More Than 300 mm

|

More than 300 mm are expected to be the dominant segment over the next five years

|

|

Application Type Analysis

|

DAO (Discrete, Analog, and Optoelectronics & Sensors), Logic, and Memory

|

Logic devices are projected to remain the largest segment

|

|

End-Use Type Analysis

|

Communication, Computer, Consumer Electronics, Industrial, Automotive, and Government

|

Computer is expected to remain the largest segment during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific is expected to remain the largest as well as the fastest-growing market over the next five years.

|

By Size Type

“More than 300 mm are expected to be the dominant segment as it held a market share of more than 45% in 2022.”

The silicon wafers market is segmented into less than 150 mm, 200 mm, and more than 300 mm. Among them, more than 300 mm are expected to remain the largest as well as the fastest-growing segment during the forecast period, primarily attributed to the augmented surface area afforded by larger wafers, facilitating the fabrication of a greater number of individual chips on a single 300 mm wafer when compared to smaller counterparts.

These 300 mm silicon wafers play a pivotal role in the manufacture of microelectronic components, encompassing transistors and integrated circuits (ICs).

By Applications Type

“Logic devices are predicted to remain the largest application as they hold a market share of more than 40% in 2022.”

The market is segmented into DAO (Discrete, Analog, and Optoelectronics & Sensors), logic, and memory. Logic devices are predicted to remain the largest application in the market over the next five years. This is largely attributed to the persistent demand for higher-performance and energy-efficient logic chips, driven by the increasing ubiquity of consumer electronics like smartphones, tablets, and laptops.

Additionally, the deployment of 5G technology is expected to reinforce this demand, compelling the development of more powerful and efficient logic chips, and further elevating the need for advanced silicon wafers.

Want to get more details about the segmentations? Register Here

By End-Use Type

“Computer segment is expected to remain the largest end-user segment as it held a market share of more than 30% in 2022.”

The silicon wafers market is segmented into communication, computer, consumer electronics, industrial, automotive, and government. Among them, the computer segment is expected to remain the largest end-use of the market, whereas the communication segment is likely to grow at the fastest pace during the forecast period.

As laptops continue to shrink in size, there is a growing demand for increased functionality from a single device, necessitating integrated circuit (IC) chips with a greater number of transistors to accommodate additional features. This is fueling the demand for high-performance Integrated Circuits (ICs) in the market.

Regional Insights

“Asia-Pacific is expected to remain the largest and fastest-growing market as it held a market share of more than 80% in 2022.”

In terms of regions, Asia-Pacific is expected to remain the largest as well as the fastest-growing market for silicon wafers during the forecast period, mainly driven by Taiwan, South Korea, China, and Japan. Taiwan is the largest semiconductor material-consuming country in the world. Furthermore, Asia-Pacific is at the forefront of technological advancements, including 5G technology, artificial intelligence (AI), and IoT applications. These advancements rely on advanced semiconductor materials and integrated circuits; thus, driving the demand for silicon wafers.

North America and Europe, sizeable markets, are also likely to create healthy growth opportunities in the coming five years, driven by increasing investments in R&D activities.

Know the high-growth countries in this report. Register Here

Key Players

The market is highly populated, with the presence of several regional and global players. Many players expand their product portfolios to include a wide range of silicon wafers, catering to diverse customer needs. This diversification involves offering silicon wafers for different applications and industries. Most of the major players are providing other semiconductor materials as well.

The following are the key players in the silicon wafers market (arranged alphabetically):

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market, covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The silicon wafers market is segmented into the following categories:

By Size Type

- Less than 150 mm

- 200 mm

- 300 mm and above

By Application Type

- DAO (Discrete, Analog, and Optoelectronics & Sensors)

- Logic

- Memory

By End-Use Type

- Communication

- Computer

- Consumer Electronics

- Industrial

- Automotive

- Government

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Click here to learn the market segmentation details.

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s silicon wafers market realities and future market possibilities for the forecast period of 2023 to 2028. After a continuous interest in our silion wafers market report from the industry stakeholders, we have tried to further accentuate our research scope to the silicon wafers market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].

Recent Market News

-

The European Commission has approved a €450 million funding package for onsemi’s integrated semiconductor manufacturing facility in the Czech Republic, which includes silicon wafer and SiC production, reinforcing the EU’s broader strategy to expand advanced semiconductor manufacturing.

-

In March 2023, Okmetic introduced a Terrace Free SOI capability for its 200 mm Bonded Silicon-On-Insulator (BSOI) and E-SOI® wafers.

-

In OCT 2022, SUMCO Corporation entered into an agreement to acquire Mitsubishi Materials Corporation’s semiconductor polysilicon operations, including Mitsubishi Polycrystalline Silicon America Corp., as part of its strategy to enhance vertical integration within its silicon supply chain.

- In MARCH 2022, SK Siltron announced an investment of 1.05 trillion KRW over the next three years to enhance its 300 mm wafer production facilities located in the National Industrial Complex, Gumi, South Korea. Starting in Q4 2022, the expansion project aims to commence mass production by the first half of 2024.