Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Aircraft Electrical Distribution Systems Market

-

The annual demand for aircraft electrical distribution systems was USD 1.6 billion in 2024 and is expected to reach USD 1.8 billion in 2025, up 10.7% than the value in 2024.

-

During the forecast period (2025 to 2032), the aircraft electrical distribution systems market is expected to grow at a CAGR of 2.8%. The annual demand will reach of USD 2.2 billion in 2032.

-

During 2025-2032, the aircraft electrical distribution systems industry is expected to generate a cumulative sales opportunity of USD 16.61 billion.

High-Growth Market Segments:

-

North American region is expected to witness the highest growth over the forecast period.

-

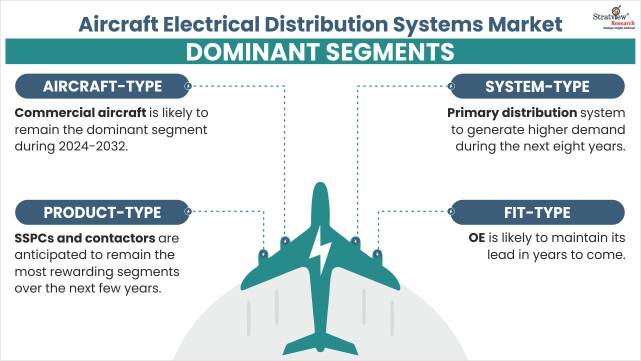

By System type, Primary Distribution System is likely to be the dominant type in the market during the forecast period.

-

By Aircraft type, Commercial Aircraft is likely to maintain its market dominance in the coming years.

-

By Product type, SSPCs and Contactors are anticipated to remain the most rewarding segments over the next few years.

-

By Fit type, OE is likely to maintain its lead in the years to come.

Market Statistics

Have a look at the sales opportunities presented by the aircraft electrical distribution systems market in terms of growth and market forecast.

|

Aircraft Electrical Distribution Systems Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 1.4 billion

|

-

|

|

Annual Market Size in 2024

|

USD 1.6 billion

|

YoY Growth in 2024: 17.0%

|

|

Annual Market Size in 2025

|

USD 1.8 billion

|

YoY Growth in 2025: 10.7%

|

|

Annual Market Size in 2032

|

USD 2.2 billion

|

CAGR 2025-2032: 2.8%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 16.61 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 1.2 billion+

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 0.8 billion to 1.1 billion

|

50% - 70%

|

Market Dynamics

Introduction:

What are aircraft electrical distribution systems?

Aircraft electrical distribution systems are networks that deliver electrical power from the aircraft’s power generation sources, such as generators or batteries, to various onboard systems and components. These systems ensure that all electrical equipment, from flight controls and avionics to lighting and cabin systems, receives a stable and continuous supply of power throughout the flight.

The distribution system includes wiring, circuit breakers, relays, switches, and power control units that manage how electricity is routed and protected. It divides the electrical load into different channels or buses, such as essential, non-essential, and emergency buses, to prioritize critical operations in case of power failure. In essence, aircraft electrical distribution systems act as the circulatory system of the aircraft’s electrical network, ensuring efficient, safe, and reliable power delivery to all vital systems.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Aircraft-Type Analysis

|

Commercial Aircraft, Regional Aircraft, General Aviation, Military Aircraft, Helicopter, and UAV.

|

Commercial aircraft is likely to remain the dominant segment during 2024-2032. Despite grabbing a minimal share, UAV is likely to log the highest CAGR during 2024-2032.

|

|

System-Type Analysis

|

Primary Distribution System and Secondary Distribution System

|

Primary distribution system to generate higher demand during the next eight years.

|

|

Product-Type Analysis

|

Solid-State Power Controllers or SSPCs, Relays, Contactors, Circuit Breakers, and Others

|

SSPCs and contactors are anticipated to remain the most rewarding segments over the next few years.

|

|

Fit-Type Analysis

|

OE and Aftermarket

|

OE is likely to maintain its lead in years to come.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is expected to remain the largest market over the next eight years, whereas Asia-Pacific is likely to grow at the fastest rate.

|

By Aircraft Type

"Commercial aircraft accounted for the largest market share."

-

Based on the aircraft type, the market is segmented as commercial aircraft, regional aircraft, general aviation, helicopter, military aircraft, and UAV. Among these aircraft types, commercial aircraft are expected to remain the biggest demand generator for distribution systems during the forecast period.

-

The aircraft type is also likely to grow at a healthy rate in the years to come. Recovering aircraft deliveries are discernible. Under its current year guidance report, Airbus is targeting to deliver 800 aircraft in 2024, as compared to 735 delivered in 2023. A sharp increase in the production rate of the A350 XWB and B787 is expected in the coming years, reaching back to 2018 levels.

Want to get a free sample? Register Here

By Product Type

"SSPC accounted for the largest market share."

-

Based on the product type, the market is segmented as solid-state power controllers (SSPC), relays, contactors, circuit breakers, and others. Among these product types, SSPC is expected to remain the most dominant product type in the market during the forecast period.

-

SSPCs are the major components used for circuit protection. SSPC generally includes the combination of a circuit breaker and a relay and is very crucial in electrically controlling and isolating a circuit in case of flow of excessive electric current or power surge incidents.

Regional Analysis

"North America accounted for the largest market share."

-

In terms of regions, North America is expected to remain the largest market for aircraft electrical distribution systems during the forecast period. The USA remains the growth propeller of the region’s market in the years to come. The country is the preferred destination for aircraft assembly with the presence of almost all the leading OEMs and tier players.

-

Asia-Pacific, the largest procurer of commercial aircraft, is also likely to create sizeable market opportunities in the coming years, driven by an expected rise in air passenger traffic coupled with a high focus on China, Japan, and India for the indigenous manufacturing of aircraft.

Want to get a free sample? Register Here

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the aircraft electrical distribution systems market -

- Safran Group

- Collins Aerospace (Raytheon Technologies Corporation)

- GE Aviation

- Honeywell International Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

4 (System Type, Aircraft Type, Product Type, Fit Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aircraft electrical distribution systems market is segmented into the following categories.

By Aircraft Type

-

Commercial Aircraft

-

Regional Aircraft

-

General Aviation

-

Helicopter

-

Military Aircraft

-

UAV

By System Type

By Product Type

By Fit Type

-

Original Equipment

-

Aftermarket

By Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, the UK, Russia, and Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s Aircraft Electrical Distribution Systems market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]