Automotive Radar Market Insights

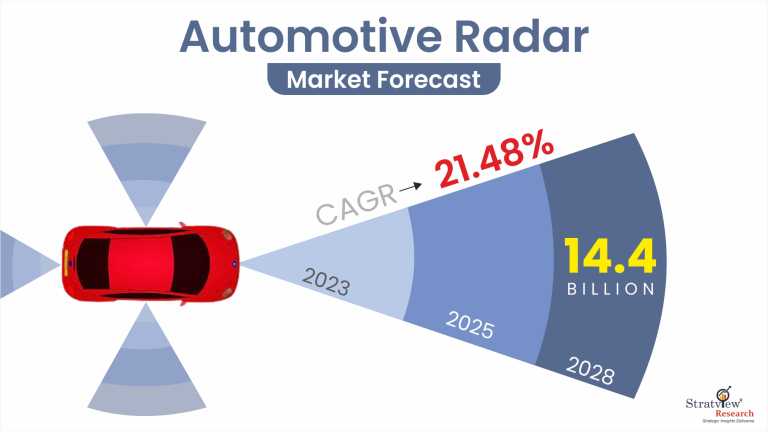

"The global automotive radar market size was estimated at USD 4.48 billion in 2022 and is likely to grow at a CAGR of 21.48% during 2023-2028 to reach USD 14.4 billion in 2028."

Wish to get a free sample? Click Here

Automotive RADAR systems are the primary sensor for adaptive cruise control systems and play a critical role in advanced driver assistance. Furthermore, automotive RADAR is an important sensor for accident prevention, vehicle and pedestrian avoidance, and other applications.

The market is being propelled by a growing focus on active safety features, advances in radar technology, lower component prices, and increased vehicle sales. Radars are used in a variety of safety systems, such as adaptive cruise control, pedestrian identification, blind spot detection, and automated emergency braking, to detect objects.

|

Automotive Radar Market Report Overview

|

|

Market Size in 2028

|

USD 14.4 Billion

|

|

Market Size in 2022

|

USD 4.48 Billion

|

|

Market Growth (2023-2028)

|

CAGR of 21.48%

|

|

Base Year of Study

|

2022

|

|

Trend Period

|

2017-2021

|

|

Forecast Period

|

2023-2028

|

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

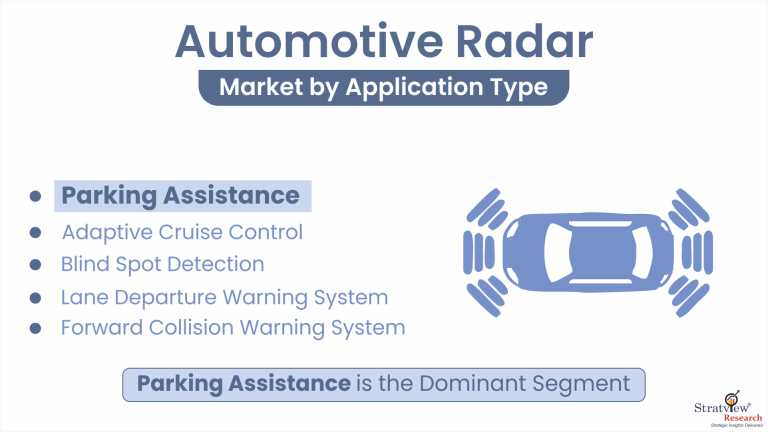

Application-Type Analysis

|

Adaptive Cruise Control (ACC), Blind Spot Detection (BSD), Lane Departure Warning System (LDWS), Parking Assistance (PA), and Forward Collision Warning System (FCWS)

|

The parking assistance segment will increase at a CAGR of over 15% during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Asia-Pacific is estimated to be the largest market during the forecast period.

|

Application Insights

"The parking assistance segment accounted for the largest market share."

The market is segmented as Adaptive Cruise Control (ACC), Blind Spot Detection (BSD), Lane Departure Warning System (LDWS), Parking Assistance (PA) and Forward Collision Warning System (FCWS). Due to the rising automotive uses of radar technology, such as parking assistance, guiding, and reverse warnings, the parking assistance segment will increase at a CAGR of over 15% during the forecast period. While parking, the parking sensors notify drivers to potential impediments in real time. The parking manoeuvre is calculated by proximity sensors as soon as the driver activates the radar park assistant.

Wish to get a free sample? Click Here

Regional Insights

"Asia-Pacific accounted for the largest market share."

The expanding initiatives and investments in the automotive sector, as well as an increase in the number of vehicle accidents, are propelling the Asia-Pacific’s automotive radar market. It is estimated that around 35 cities in China have around 1 million cars on the road, causing traffic congestion and accidents on 75 percent of the roadways. Automobile radar sensors, which direct the driver along the path, are being used by automobile makers to assure vehicle and driver safety. Companies in the industry are promoting their next-generation transportation technology in order to reduce traffic congestion and improve overall transportation convenience.

Want to get a free sample? Register Here

Key Players

The following are the key players in the automotive radar market (arranged alphabetically)

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Recent Developments of Automotive Radar Market

Recent Product Developments

In 2025, Texas Instruments introduced the AWRL6844, a 60GHz mmWave radar sensor designed for in-cabin sensing. This sensor supports features like adaptive cruise control, automated emergency braking, and occupant detection through edge AI algorithms, reducing implementation costs by approximately USD 20 per vehicle. It enhances safety and comfort in next-generation vehicles, with adoption by major automakers like General Motors and Ford.

In 2025, Volkswagen announced a robotaxi for Uber’s Los Angeles fleet, equipped with five radar sensors as part of a 13-camera, roof-mounted lidar system. The radar array enables object detection at ranges up to 300 meters, supporting autonomous driving capabilities. Deliveries are set to begin in 2026.

In 2024, Magna, a leading automotive supplier, acquired Uhnder in August 2024, gaining access to Uhnder’s digital code-modulated radar architecture. This technology produces 192 virtual channels through sub-millimeter phase coding, enhancing radar resolution and enabling features like pedestrian detection and urban navigation.

In 2024, Renesas introduced a modular radar reference design separating radio front-end, baseband, and AI accelerator tiles on an embedded glass substrate. This design uses 65-gigabit-per-second SerDes links, allowing OEMs like Ford and Changan to swap third-party accelerators, reducing development time by an average of 14 weeks. The design enhances flexibility and scalability for automotive radar systems.

Report Features

This report provides intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into the dynamics and will enable strategic decision making for the existing players as well as those willing to enter the market.

What Deliverables Will You Get in this Report?

|

Key questions this report answers

|

Relevant contents in the report

|

|

How big is the sales opportunity?

|

In-depth analysis of the Automotive Radar Market.

|

|

How lucrative is the future?

|

The market forecast and trend data and emerging trends.

|

|

Which regions offer the best sales opportunities?

|

Global, regional and country-level historical data and forecasts.

|

|

Which are the most attractive market segments?

|

Market segment analysis and Forecast.

|

|

Which are the top players and their market positioning?

|

Competitive landscape and Market share analysis.

|

|

How complex is the business environment?

|

Porter’s five forces, PEST and Life cycle analysis.

|

|

What are the factors affecting the market?

|

Drivers & challenges.

|

|

Will I get the information on my specific requirement?

|

10% free customization.

|

Market Segmentation

The market is segmented into the following categories:

By Application Type

-

Adaptive Cruise Control (ACC)

-

Blind Spot Detection (BSD)

-

Lane Departure Warning System (LDWS)

-

Parking Assistance (PA)

-

Forward Collision Warning System (FCWS)

By Region

-

North America (Country Analysis: the USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and the Rest of Europe)

-

Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and the Rest of Asia-Pacific)

-

Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s automotive radar market realities and future market possibilities for the forecast period. The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry at [email protected].