Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Aircraft Floor Panel Market:

-

The annual demand for aircraft floor panel was USD 525.23 million in 2025 and is expected to reach USD 544.14 million in 2026, up 3.60% than the value in 2025.

-

During the forecast period (2026-2034), the aircraft floor panel market is expected to grow at a CAGR of 2.70%. The annual demand will reach USD 673.34 million in 2034.

-

During 2026-2034, the aircraft floor panel industry is expected to generate a cumulative sales opportunity of USD 5510.49 million.

High-Growth Market Segments:

-

North America is projected to retain its supremacy during the forecast period, whereas Asia-Pacific is expected to experience the fastest growth.

-

By Aircraft type, Narrow-Body aircraft are anticipated to drive demand for the aircraft floor panel market, whereas Wide-Body aircraft are expected to experience the fastest growth rate in the coming years.

-

By Core Material type, Nomex Honeycomb is expected to remain the largest and fastest-growing system type in the market during the forecast period.

-

By Sales Channel type, SFE is expected to remain the largest segment in the market.

-

By End-User type, OE is estimated to remain the largest and fastest-growing end-user type in the market over the forecast period.

Market Statistics:

Have a look at the sales opportunities presented by the aircraft floor panel market in terms of growth and market forecast.

|

Aircraft Floor Panel Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Million)

|

Market Growth (%)

|

|

Annual Market Size in 2024

|

USD 506.00 million

|

-

|

|

Annual Market Size in 2025

|

USD 525.23 million

|

YoY Growth in 2025: 3.80%

|

|

Annual Market Size in 2026

|

USD 544.14 million

|

YoY Growth in 2026: 3.60%

|

|

Annual Market Size in 2034

|

USD 673.34 million

|

CAGR 2026-2034: 2.70%

|

|

Cumulative Sales Opportunity during 2026-2034

|

USD 5510.49 million

|

-

|

|

Top 10 Countries’ Market Share in 2025

|

USD 420.18 million +

|

> 80%

|

|

Top 10 Company’s Market Share in 2025

|

USD 262.61 million to USD 367.66 million

|

50% - 70%

|

Market Dynamics

What is an Aircraft Floor Panel?

-

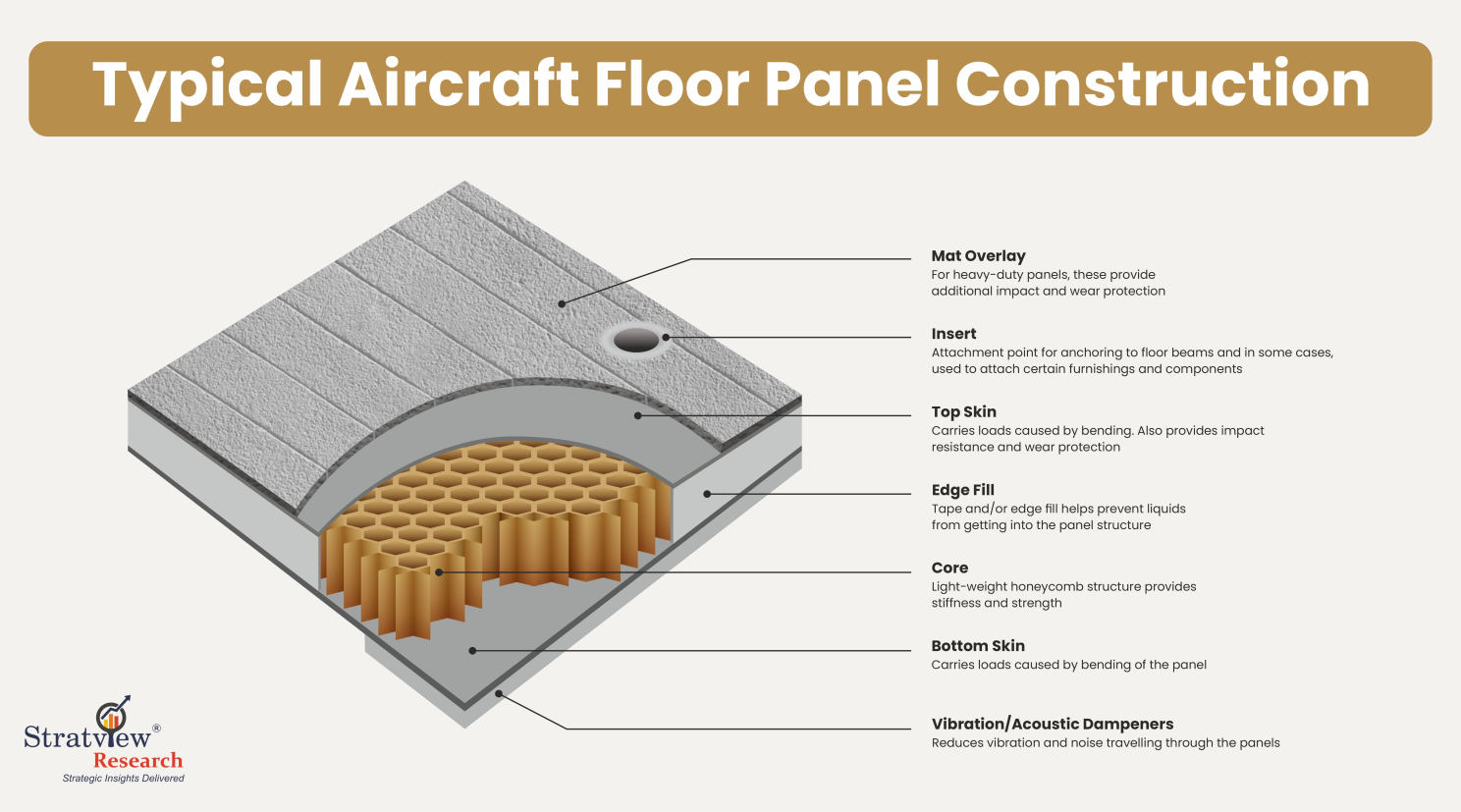

An aircraft floor panel is a load-bearing, structural interior component installed over fuselage floor beams to form the primary walking and equipment-support surface of the aircraft cabin. It supports passengers, seats, galleys, lavatories, and other interior systems, and transfers these loads into the aircraft’s primary structure.

-

Although concealed beneath carpets and cabin finishes, aircraft floor panels are not cosmetic elements. They are engineered, tested, and certified components designed to meet stringent airworthiness, structural, and safety requirements.

Market Drivers:

Growth in Global Air Travel and Aircraft Fleet Expansion

-

According to Airports Council International World (ACI), global commercial air traffic is projected to exceed 10 billion passengers in 2026, reflecting strong post-pandemic recovery and sustained growth in air travel demand. In addition, Boeing’s Commercial Market Outlook forecasts over 40,000 new aircraft deliveries by 2043.

-

This sustained rise in passenger volumes and long-term fleet expansion is substantially increasing demand for aircraft floor panels for new aircraft production, cabin retrofits, and routine maintenance across North America, Europe, and the Asia-Pacific region.

Rising Demand for Lightweight and Fuel-Efficient Aircraft

- According to the International Air Transport Association (IATA), jet fuel accounts for upto 30% of total airline operating costs. To reduce fuel consumption and emissions, airlines and OEMs are increasingly adopting lightweight interior components. As stated in Boeing and Airbus sustainability reports, composite and honeycomb floor panels help lower aircraft weight, directly improving fuel efficiency and supporting environmental compliance.

Market Challenges:

Stringent Regulatory and Certification Requirements

-

Aircraft interior components must comply with rigorous safety standards set by regulatory bodies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). Floor panels must meet strict flammability, smoke emission, and structural load requirements. Certification involves extensive testing, documentation, and regulatory approvals, which can extend over multiple development cycles, delaying commercialization and increasing compliance costs for manufacturers.

High Cost of Advanced Materials and Manufacturing Processes

-

Advanced composite materials, fire-resistant resins, and honeycomb core structures used in aircraft floor panels require specialized manufacturing processes and strict quality controls. These materials involve complex curing, inspection, and testing procedures, resulting in higher production costs compared to conventional structures.

-

High capital investment in automated fabrication systems and certification infrastructure further raises entry barriers, particularly for small and mid-sized suppliers.

Market Opportunities:

Rising Demand for Cabin Modernization and Retrofit Programs

-

According to our analysis, the global aircraft maintenance, repair, and overhaul (MRO) demand is expected to exceed USD 300 billion in 2035, with a substantial portion allocated to cabin refurbishment, interior upgrades, and structural component replacement.

-

This expanding aftermarket ecosystem presents a major growth opportunity for aircraft floor panel manufacturers, as airlines and operators increasingly invest in certified, lightweight, and durable interior components to extend fleet life and enhance operational efficiency across commercial and business aviation fleets.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

By Aircraft Type Analysis

|

Narrow-Body Aircraft, Wide-Body Aircraft, Regional Aircraft, and Business Jets

|

Narrow-body aircraft are anticipated to drive demand for the aircraft floor panel market, whereas wide-body aircraft are expected to experience the fastest growth rate in the coming years.

|

|

By Core Material Type Analysis

|

Nomex Honeycomb, Aluminium Honeycomb, and Other Core Material Types.

|

Nomex honeycomb is anticipated to be the most preferred core material of the aircraft floor panel market and is expected to witness the fastest growth in the coming years.

|

|

By Sales Channel Type Analysis

|

BFE and SFE

|

SFE is anticipated to maintain its dominance, and BFE is expected to achieve faster growth during the forecast period.

|

|

By End-User Type Analysis

|

OE and Aftermarket

|

OE is expected to maintain its dominance during the forecast period and is likely to be the fastest-growing segment during the same period.

|

|

By Region

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is projected to retain its supremacy during the forecast period, whereas Asia-Pacific is expected to experience the fastest growth.

|

By Aircraft Type

"Narrow-Body Aircraft Remain Dominant, While Wide-Body Aircraft Show Strong Growth Potential"

- The market is segmented into narrow-body aircraft, wide-body aircraft, regional aircraft, and business jets.

- Narrow-body aircraft continue to dominate due to high production volumes for short- and medium-haul routes. Rising demand for fuel-efficient models such as the A320neo and 737 MAX is supporting sustained panel demand.

- Wide-body aircraft are witnessing renewed growth, supported by production ramp-ups of long-haul platforms such as the Boeing 787 and Airbus A350. Increasing international travel is strengthening long-term prospects for this segment.

By Core Material Type

"Nomex Honeycomb Remains the Leading Core Material"

- The market is segmented into Nomex honeycomb, aluminum honeycomb, and other core materials.

- Nomex honeycomb dominates due to its lightweight structure, high rigidity, thermal stability, fire resistance, and corrosion resistance. These properties make it suitable for both narrow-body and wide-body aircraft applications.

By End-User Type

"OE Segment Leads Demand Generation"

- The market is segmented into original equipment (OE) and aftermarket.

- The OE segment remains dominant, supported by rising aircraft production rates and new program launches such as COMAC C919 and Boeing 777X. At the same time, the aftermarket segment is witnessing strong growth due to increasing fleet age and refurbishment cycles.

Regional Analysis

"North America Maintains Market Leadership, While Asia-Pacific Emerges as the Fastest-Growing Region"

- North America remains the largest market due to the presence of major aircraft OEMs, interior system suppliers, and advanced manufacturing infrastructure.

- Asia-Pacific is expected to witness the fastest growth, supported by expanding airline fleets, rising passenger traffic, and increasing aircraft assembly activities in China and Southeast Asia.

- Europe continues to play a vital role, driven by Airbus production facilities and strong regulatory frameworks.

Want to get a free sample? Register Here

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the aircraft floor panel market -

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

December 2025 – Boeing Completes Spirit AeroSystems Acquisition

- Boeing finalized its USD 4.7 billion acquisition of Spirit AeroSystems, significantly realigning commercial aerospace supply chains. This strategic move brings major aerostructure manufacturing in-house, affecting the production ecosystem for aircraft structural components, including interior systems such as floor panels and composite assemblies.

September 2025 – Safran Explores Sale of Aircraft Interiors Assets

- Safran announced it was exploring the sale of a large portion of its aircraft interiors business, potentially worth EUR 1.5 billion (≈ USD 1.76 billion). The assets include interior components from overhead bins to galley fittings, signaling possible supplier market restructuring that could impact interior part sourcing and manufacturing.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2034

|

|

Base Year

|

2025

|

|

Forecast Period

|

2026-2034

|

|

Trend Period

|

2019-2024

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Aircraft Type, Core Material Type, Sales Channel Type, End-Use Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aircraft floor panel market is segmented into the following categories:

Aircraft Floor Panel Market, by Aircraft Type

-

Narrow-body aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Wide-body aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Regional Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Business Jets (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Floor Panel Market by Core Material Type

-

Nomex Honeycomb (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Aluminum Honeycomb (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Other Core Material Types (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Floor Panel Market by Sales Channel Type

-

BFE (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

SFE (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Floor Panel Market by End-User Type

-

OE (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Aftermarket (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Floor Panel Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, Russia, and Rest of Europe)

-

Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aircraft floor panel market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]