Automotive Electronics Market Insights

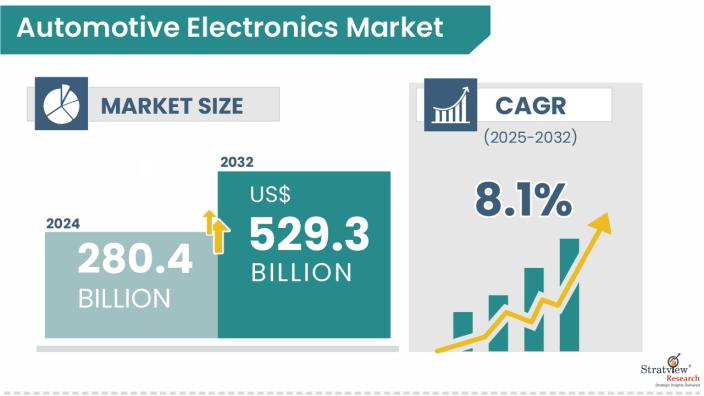

The automotive electronics market was estimated at USD 280.4 billion in 2024 and is likely to grow at a CAGR of 8.1% during 2025-2032 to reach USD 529.3 billion in 2032.

Want to get a free sample? Register Here

Automotive Electronics Market Dynamics

Automotive Electronics Market Drivers

-

Rising awareness regarding safety and strict automotive regulations— Growing consumer awareness and regulatory needs for safety features like Advanced Driver Assistance Systems (ADAS), lane departure warning, autonomous braking systems, airbags, and collision warning systems are the driving factors. Various estimates suggest the global ADAS market is expected to grow from 334 million units in 2024 to 655 million units by 2030.

-

Rising trend of electric vehicles— Rising trend of EVs due to the awareness regarding the environment, advancements in battery technology, low maintenance cost and low fuel costs of vehicles. According to the IEA, the global EV sales share is expected to grow from around 15% in 2023 to almost 40% in 2030, resulted from improved battery efficiency, lower maintenance costs and fast charging networks.

-

Consumer preferences for connected and smart vehicles— Smart or connected cars are one step ahead by embedded technologies like AI, ML, and IOT. Consumers are demanding better connectivity features such as smart navigation systems, infotainment systems, touchscreen and voice recognition.

Automotive Electronics Market Challenges

-

High development and manufacturing costs: One of the significant factors restraining the growth is high costs involved in installing electronic systems and technologies in cars. High raw material and component costs, mostly semiconductors, batteries and sensors, drive up the overall cost of cars.

-

Supply chain disruptions: Raw material and component shortages due to supply chain disruptions resulting from trade bans or geopolitical factors is a challenge this market. Component shortages, like memory chips, processors, semiconductors, and batteries, resulted in delays in the production of vehicles and restricted the availability of some models.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Application Type Analysis

|

ADAS [Adaptive Cruise Control, Blind Spot Detection, Parking Assistance, Automated Emergency Braking, Night Vision, and Lane Departure Warning], Body Electronics, Infotainment & Communication [Audio, Display, Navigation, Head-up Display, and Communication], Powertrain [Engine Controllers, Transmission Drivetrain, Exhaust, and xEV], and Safety Systems

|

The ADAS segment accounted for the largest market share during the forecast period.

|

|

Vehicle Type Analysis

|

Passenger Cars, Commercial Vehicles

|

The passenger car segment is poised to be the leading segment in this market during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

The Asia-Pacific region is leading the automotive electronics market and is projected to be the fastest-growing market in the coming years.

|

By Application Type

"The ADAS segment accounted for the largest market share during the forecast period."

The market is divided into ADAS, body electronics, infotainment & communication, powertrain, and safety systems. The ADAS segment is projected to grow at a higher rate during the forecast period.

The growing awareness of road safety is one of the reasons for the high demand. ADAS plays a crucial role in improving vehicle safety by providing features such as blind spot detection, lane assistance, collision warning, parking assistance, etc. Autonomous vehicles, also known as self-driving cars, are incorporated with ADAS, having AI-driven monitoring systems, increased connectivity with higher-level sensors and integration of machine learning for enhanced decision-making in ADAS.

By Vehicle Type

"The passenger car segment accounted for the largest market share during the forecast period."

The market is divided into passenger cars and commercial vehicles. The passenger car segment is poised to be the leading segment in this market during the forecast period.

Ongoing technological advancements in passenger vehicles, focusing on safety, comfort, and enhanced performance, are driving demand for these vehicles, which in turn fuels the need for more electronics, including advanced infotainment systems, connectivity systems, built-in navigation, and more.

Regional Insights

"The Asia-Pacific accounted for the largest market share during the forecast period."

The market is segmented into North America, Europe and the Asia-Pacific region.

The Asia-Pacific region is leading the automotive electronics market and is projected to be the fastest-growing market in the coming years due to the growing automotive industry.

APAC is an automotive manufacturing hub, where China, Japan, and South Korea are the major countries, providing growth opportunities in the vehicle and component manufacturing sector in this region.

The rising disposable incomes, urbanization, and infrastructure development are further expanding the automotive industry in APAC countries. The growth is further supported by the top semiconductor suppliers’ presence in the region and the easy availability of power electronics components and devices.

Want to get a free sample? Register Here

Key Players

Some of the key players in the automotive electronics market are:

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Recent Developments of Automotive Electronics Market

In July 2023, HELLA and Porsche joined forces in collaboration with other partners to introduce an innovative high-resolution headlamp system known as the 'SSL | HD.' This cutting-edge system incorporates matrix LED technology and boasts an impressive 32,000 individually adjustable pixels per headlamp. Notably, it has been introduced as an optional feature for the all-new Porsche Cayenne, marking the first time this advanced technology has been made available in this vehicle model.

In July 2023, Continental made a significant announcement regarding its plans to equip the entire Conti Urban bus tire line with the latest sensor technology. This move towards integrating sensors into their products is part of Continental's ongoing commitment to digitalizing fleet management. Starting from August 2023, customers will have access to the new range of smart tires, including the Conti UrbanScandinavia HD3, Conti Urban HA3, and Conti UrbanScandinavia HA3+. This strategic development aligns with Continental's forward-looking approach to enhance fleet operations through advanced digital solutions.

In May 2023, Valeo unveiled a significant strategic partnership with DiDi Autonomous Driving. Under this collaboration, Valeo has made a strategic investment in DiDi Autonomous Driving, and the two companies are working together to pioneer cutting-edge safety solutions for Level 4 autonomous vehicles, specifically robotaxis.

In May 2023, HELLA revealed its receipt of numerous customer orders for their cutting-edge steering sensors. These advanced sensors are a pivotal component in driving the development of steer-by-wire systems. HELLA is slated to commence production of this sensor series for its customers in 2025, with manufacturing operations set to take place at HELLA's electronic facilities located in Xiamen, China, and Recklinghausen, Germany. The developmental aspects of this project will be overseen at the company's headquarters in Lippstadt, Germany.

In May 2023, According to IAR Systems, the RISC-V architecture it offers has significant potential for development in Taiwan, especially within the automotive electronics industry. In addition, Meta has successfully developed an in-house Artificial Intelligence (AI) chip based on this architecture.

In March 2023, xEVs announced its strategic initiative to offer fresh avenues for the implementation of vehicle sensors. The company's objective is to address the growing demand for efficient management of electrical current and temperature regulation in various circuits, such as charging and drivetrain, as well as hybrid and battery-powered vehicle configurations.

In March 2023, Lumotive, a company based in the United States, successfully developed a silicon-based semiconductor that utilizes sophisticated software to control the direction of a beam. This technology enables accurate detection of a vehicle's surroundings. The chips have been specifically designed to meet the safety requirements of various automotive industries.

In January 2023, HARMAN, a subsidiary of Samsung Electronics and an automotive technology company, recently unveiled its newest range of vehicle electronics products. At the CES 2023 event, the company presented its latest line of products. HARMAN exhibited a range of offerings including Ready Care, Ready Display, Ready on Demand, Ready Upgrade, Ready Vision, and Sound & Vibration Sensor External Microphone.

In April 2023, HARMAN has recently established an Automotive Engineering Centre in Chennai, India with the objective of securing a prominent position as a supplier of vehicle electronics in the country.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The automotive electronics market is segmented into the following categories:

By Application Type

-

ADAS [Adaptive Cruise Control, Blind Spot Detection, Parking Assistance, Automated Emergency Braking, Night Vision, and Lane Departure Warning]

-

Body Electronics

-

Infotainment & Communication [Audio, Display, Navigation, Head-up Display, and Communication]

-

Powertrain [Engine Controllers, Transmission Drivetrain, Exhaust, and xEV]

-

Safety Systems

By Vehicle Type

-

Passenger Cars

-

Commercial Vehicles

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s automotive electronics market realities and future market possibilities for the forecast period of 2025 to 2032. After a continuous interest in our automotive electronics market report from the industry stakeholders, we have tried to further accentuate our research scope to the automotive electronics market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].