Market Insights

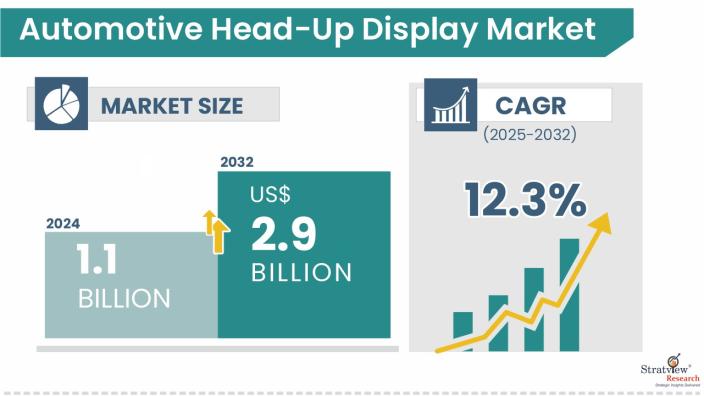

The automotive head-up display market was estimated at USD 1.1 billion in 2024 and is likely to grow at a CAGR of 12.3% during 2025-2032 to reach USD 2.9 billion in 2032.

Wish to get a free sample? Register Here

Market Dynamics

Introduction

An automotive head-up display is a transparent display that is installed in such a way in the vehicle that the driver does not have to get diverted from their viewpoint while driving. It is mainly installed on the dashboard and the results are shown on the projector. Automotive head-up display is a new concept that is used now in higher-end vehicles as of now. Noticing the security benefits, there are chances that it can be used in other vehicles too in the future.

Market Drivers

Growing Focus on Road Safety and Driver Assistance: The increasing emphasis on road safety and driver assistance features is a major driver for HUD adoption. By projecting essential information like speed, navigation, and collision alerts directly onto the windshield, HUDs help drivers stay informed without diverting their eyes from the road. This supports faster reaction times and reduces distractions. As regulatory bodies push for safer vehicle designs, HUDs are being integrated across more vehicle segments.

Rising Demand for Premium and Connected Vehicles: The demand for connected, high-end vehicles is boosting the HUD market as consumers seek enhanced in-cabin technology and a futuristic driving experience. HUDs are now a standard or optional feature in many luxury and premium vehicles, serving as a differentiator in a competitive market. These systems often integrate with AR, navigation, and infotainment platforms. With global luxury vehicle sales on the rise, the HUD market is expanding alongside.

Technological Advancements and Cost Reduction: Rapid advancements in optics, projection systems, and AR integration are making HUDs more capable and cost-effective. Innovations like augmented reality overlays, wider field-of-view projection, and compact HUD modules are enabling automakers to integrate the technology even in mid-range vehicles. Additionally, economies of scale and supplier competition have lowered the cost of production. As a result, HUDs are no longer limited to luxury vehicles but are entering mass-market segments.

Key Players

Excellent growth in the market is attracting other players to enter the market. Advancement in technology, development of cost-effective solutions, and collaboration with OEMs are some of the key strategies adopted by major companies to gain a competitive edge over others.

Some of the well-known manufacturers of head-up displays for the automotive industry are

- Nippon Seiki Co., Ltd.

- Continental AG

- Denso Corporation

- Visteon Corporation

- Yazaki Corporation

- Pioneer Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Delphi Automotive Plc

- MicroVision Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Vehicle Type Analysis

|

Luxury Cars, Sports Cars, Mid-Segment Cars, and Basic Segment Cars

|

Luxury cars are projected to remain the largest segment in the market during the forecast period.

|

|

Product Type Analysis

|

Windshield and Combiner

|

Windshield projectors are expected to remain the largest product type in the market during the forecast period.

|

|

End-User Type Analysis

|

OEM and Aftermarket

|

OEM is expected to remain the largest end-user type in the market over the next five years.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Asia-Pacific dominates the automotive head-up display (HUD) market.

|

By Vehicle Type

The automotive head-up display market is segmented based on vehicle type: luxury cars, sports cars, mid-segment cars, and basic-segment cars. Luxury car is projected to remain the largest segment in the market during the forecast period. All major luxury car manufacturers, such as BMW, Mercedes-Benz, and Audi are incorporating the head-up display into some of their models. These luxury car manufacturers are also working with the head-up display manufacturers to introduce these systems into their mid-segment cars. This will drive the demand for head-up displays in mid-segment cars in the coming five years.

By Product Type

The market is further segmented based on product type such as windshield and combiner. Windshield projectors are expected to remain the largest product type in the market during the forecast period, driven by higher use in luxury vehicles. Both projector types (windshield and combiner) are likely to witness double-digit growth rates over the next five years; however, combiner projector-based head-up displays are expected to grow at a much higher rate in the same period, propelled by its low cost and smaller in size.

By End-User Type

OEM is expected to remain the largest end-user type in the market over the next five years, driven by increasing adoption from luxury to mid-segment carmakers. There is also good growth expected in the aftermarket in the same period.

Regional Insights

Asia-Pacific dominates the automotive head-up display (HUD) market due to its massive vehicle production, rising adoption of advanced driver-assistance systems (ADAS), and strong presence of leading automakers. Countries like China, Japan, South Korea, and India are rapidly integrating HUDs into both premium and mid-range vehicles, driven by growing consumer demand for enhanced driving safety and connected car features. Additionally, the region benefits from cost-effective manufacturing, government incentives for smart mobility, and a tech-savvy population embracing AR-based driving interfaces. The expansion of electric vehicles (EVs) and increased localization of HUD technologies further strengthen Asia-Pacific’s leadership in this fast-evolving market.

Know the high-growth countries in this report. Click Here

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s automotive head-up display market realities and future market possibilities for the forecast period of 2025 to 2032. After a continuous interest in our automotive head-up display market report from the industry stakeholders, we have tried to further accentuate our research scope to the automotive head-up display market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The automotive head-up display market is segmented in the following ways:

By Vehicle Type

- Luxury Cars

- Sports Cars

- Mid-Segment Cars

- Basic-Segment Cars

By Product Type

- Windshield Projected

- Combiner Projected

By Component Type

- Display Combiner

- Display Panel

- Projector

- Video Generator

- Software

- Others

By End-User Type

By Region

- North America (Country Analysis: USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, South Korea, India, and the Rest of Asia-Pacific)

- Rest of the world (Country Analysis: Brazil, Argentina, and Others)

Click Here, to know the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3)

- SWOT analysis of key players (up to 3)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].