Market Insights

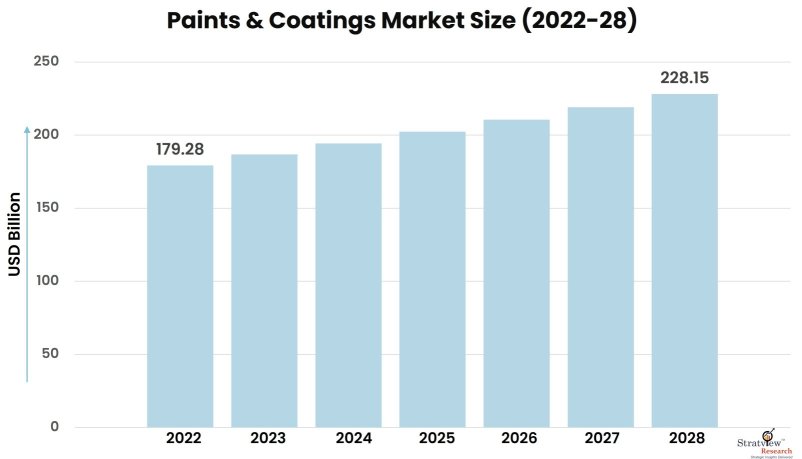

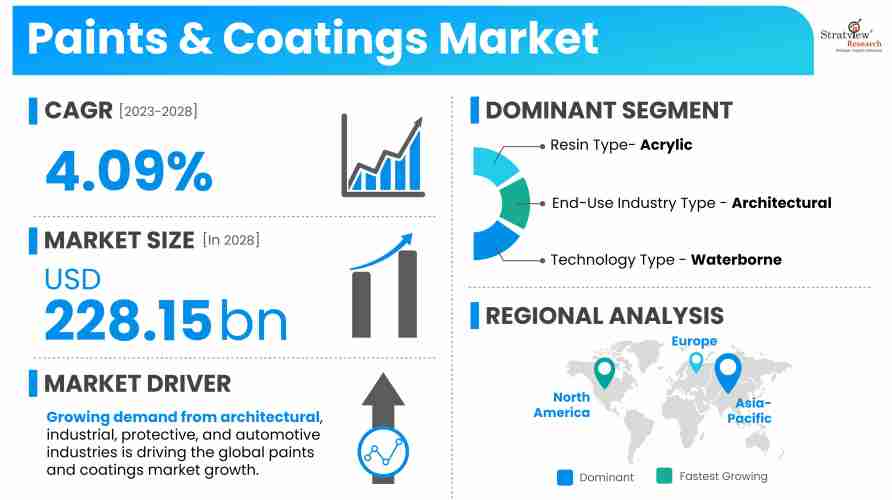

The paints & coatings market was estimated at USD 179.28 billion in 2022 and is likely to grow at a CAGR of 4.09% during 2023-2028 to reach USD 228.15 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Paints & coatings include a liquid mixture that is a solid pigment in a liquid vehicle. They are used as a decorative or protective coating in the construction industry. They enhance appearance, protect against corrosion and environmental damage, and provide functional benefits. These products find widespread use in the construction, automotive, aerospace, and consumer goods industries.

Pigments (colourants), binders (resins), solvents, and additives are the main ingredients of paints. While binders keep the pigment particles bound and affixed to the surface, pigments add color. A solid coating is left behind when solvents aid in dissolving the binders and making the application easier to dissipate.

Market Drivers

The major factors driving the growth of the paints & coatings market are:

Booming Construction and Infrastructure Development refers to the rapid expansion of residential, commercial, industrial, and public infrastructure projects across the globe. This growth is driven by increasing urbanization, population growth, economic development, and government investment in smart cities, transportation, energy, and housing. As construction scales up, it creates substantial demand for paints and coatings for protection, aesthetics, durability, and compliance with environmental standards.

Expansion of the Automotive Industry: The automotive sector's growth, particularly in emerging economies, is propelling the demand for high-performance coatings. These coatings are essential for vehicle durability and aesthetics. For instance, PPG Industries announced a $300 million investment to enhance its manufacturing capabilities in North America, aiming to meet the rising demand for automotive paints and coatings.

Shift Towards Eco-Friendly and Sustainable Products: Increasing environmental awareness and stringent regulations are driving the adoption of low-VOC and water-based coatings. Consumers and industries are seeking sustainable alternatives that minimize environmental impact, leading to innovations in eco-friendly paint formulations.

Want to have a closer look at this market report? Click Here

Challenges

Volatility in Raw Material Prices: Resins, pigments, solvents, and additives—many derived from crude oil—are subject to global price fluctuations. Disruptions in supply chains (e.g., due to geopolitical issues or natural disasters) significantly impact production costs and profit margins.

Stringent Environmental Regulations: Many governments are tightening rules on Volatile Organic Compounds (VOCs) and hazardous chemicals. This forces manufacturers to reformulate products, often increasing R&D costs and lengthening time-to-market for eco-friendly alternatives.

Opportunity:

Growing use of fluoropolymers in the building and construction sector: Fluoropolymers are increasingly utilized in the building and construction industry due to their exceptional durability and resistance to environmental factors. These materials provide exceptional defense against UV rays, moisture, and chemical contact, making them perfect for uses like roofing, cladding, and façade systems. The growing emphasis on sustainable and long-lasting building materials has led to a surge in the adoption of fluoropolymers, positioning them as a key component in modern construction practices. The growing emphasis on sustainable and long-lasting building materials has led to a surge in the adoption of fluoropolymers, positioning them as a key component in modern construction practices.

Key Players

The following are the key players in the market (arranged alphabetically).

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected].

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Resin-Type Analysis

|

Acrylic, Alkyd, Epoxy, Polyester, Polyurethane, and Others

|

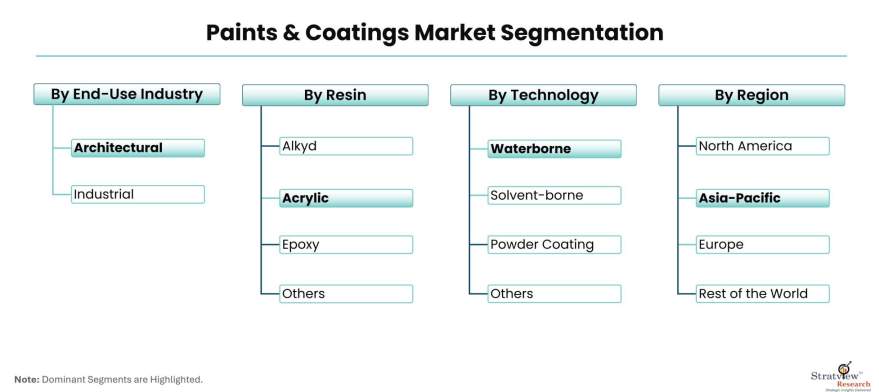

The acrylic segment held a 40% market share in 2022 and is expected to remain dominant during the forecast period.

|

|

End-Use Industry-Type Analysis

|

Architectural, Industrial

|

The architectural segment accounted for the larger share by application in 2022.

|

|

Technology-Type Analysis

|

Waterborne, Solvent-borne, Powder Coatings, and Others

|

The waterborne segment held a 35% market share in 2022 and is expected to remain dominant over the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

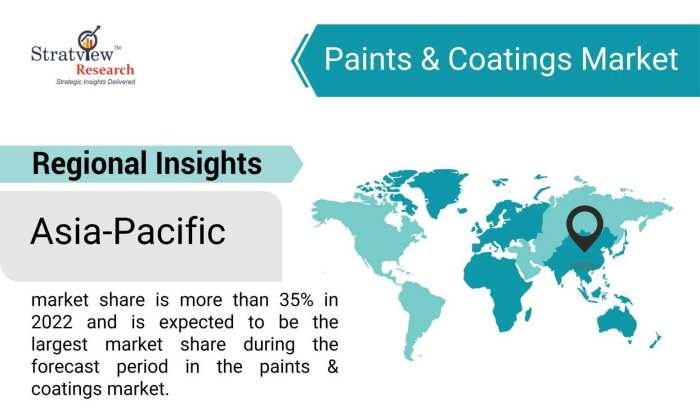

Asia-Pacific market share is more than 35% in 2022 and is expected to be the largest market share during the forecast period in the global market.

|

By End-Use Industry Type

"The architectural segment accounted for the largest market share."

The market is segmented as architectural and industrial. The architectural segment accounted for the larger share by application in 2022, owing to government focus on residential construction especially in China and India.

By Resin Type

"The acrylic segment accounted for the largest market share."

The market is segmented as acrylic, alkyd, epoxy, polyester, polyurethane, and others. The acrylic segment held a 40% market share in 2022 and is expected to remain dominant during the forecast period. The significant share of the acrylic segment is attributed to resistance to weathering & oxidation and the availability of a variety of high-gloss colours. The utility of acrylic for outdoor applications coupled with its moderate price will augment the segmental growth over the forecast period.

By Technology Type

"The waterborne segment accounted for the largest market share."

The paints & coatings market is segmented as waterborne, solvent-borne, powder coating, and others. The waterborne segment held a 35% market share in 2022 and is expected to remain dominant over the forecast period. The dominance of the waterborne segment is due to low flammability, ease of use, eco-friendly properties, and less hazardous disposal associated with the technology type.

Regional Insights

"Asia-Pacific accounted for the largest market share of more than 35% in 2022 and is expected to be the fastest-growing market during the forecast period."

The high share is attributed to the growing economy and expanding construction industry. Rapid urbanization especially in China and India will augment the regional growth. North America is anticipated to offer significant growth opportunities over the forecast period, with the US being the major country.

Know the high-growth countries in this report. Register Here

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s paints & coatings market realities and future market possibilities for the forecast period. The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The paints & coatings market is segmented into the following categories.

By Resin Type

- Acrylic

- Alkyd

- Epoxy

- Polyester

- Polyurethane

- Others

By End-Use Industry Type

By Technology Type

- Waterborne

- Solventborne

- Powder Coating

- Others

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and the Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Click here to learn the market segmentation details.

Report Customization Options

Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players).

- SWOT analysis of key players (up to 3 players).

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].